You will pay Lenders Mortgage Insurance if you don’t have a 20% deposit saved when applying for a home loan. Here I explain what it is and how avoid it.

As a Mortgage Broker, I help my clients reduce or avoid the amount of Lenders Mortgage Insurance (LMI) they pay.

Most of the time I can save them several thousands of dollars, but the better option is to avoid paying it altogether.

This post explains the best ways reduce and avoid paying Lenders Mortgage Insurance, including the latest on the Federal Governments First Home Loan Deposit Scheme.

What is Lenders Mortgage Insurance (LMI)?

If you do not have a 20% deposit saved when you go to buy a home, you will need to pay an extra fee called Lenders Mortgage Insurance (LMI).

Read more here on the basic’s of Lenders Mortgage Insurance.

When do I need to pay Lenders Mortgage Insurance

The trigger to pay LMI is:

- You have less than a 20% deposit saved to buy a home, based on the value of the property

- If you are lucky enough to have a bigger deposit, of 20% or higher saved, then you will not need to pay LMI.

How long is my Lenders Mortgage Insurance valid for?

It covers you (and the bank) for the life of your home loan which is typically 30 years.

In saying that though, it’s important to know upfront that if you buy a home today but are planning on renovating your home in 3 years time, you may also pay LMI again when you do a loan increase for the renovations. If you borrow more money, and your equity/deposit becomes less than 20% of the purchase price of the property.

You will need to have saved a 20% deposit to avoid paying Lenders Mortgage Insurance.

When is the Lenders Mortgage Insurance payment due?

LMI is paid when you home loan settles, which is usually when you take ownership of the property/property settlement.

In terms of how you pay, you can either:

- Add it to your home loan which is known as capitalising your LMI, or

- Pay for it using part of your house deposit.

I recommend you capitalise the cost of the LMI to your home loan rather than if they pay it out of your deposit, however I can go through this with you.

Do I need to pay LMI if I’m buying an investment property, vacant land or building?

Yes, LMI needs to be paid when you are borrowing more than 80% of the value of the property (i.e you have less than a 20% deposit).

This includes when you’re buying an investment property, vacant land or building a home.

How is Lenders Mortgage Insurance calculated?

Just like car or health insurance premiums are different between providers, the amount of Lenders Mortgage Insurance you need to pay will vary depending on 3 things;

- The amount of your home loan;

- Which lender you are taking out the loan with;

- The loan to valuation ratio of the loan that you’re borrowing.

I cover this in more detail below.

How can I avoid paying Lenders Mortgage Insurance altogether?

These are the five ways to avoid paying LMI:

#1: Have a 20% deposit:

- If you don’t have at least a 20% deposit, and you don’t meet one of the other three criteria below, then you will pay LMI.

- For example, you would need at least $100,000 as a deposit if the home you’re buying is worth $500,000.

- It’s important to remember that if you’re building your first home, you can include the Queensland Government Building Grant as a part of your deposit (at the moment this is $20 000).

#2: Take advantage of the Federal Governments First Home Loan Deposit Scheme:

- As of January 2020, first home buyers who fit certain criteria can buy a property and avoid paying LMI

- There is some criteria around this, for example:

- The value of your property must be under set thresholds

- Your income needs to be under set thresholds

- Read the full eligibility criteria here

#3: Work in certain professions:

- If you work in certain professions accepted by the lenders, then you only need to pay a 15% deposit to avoid LMI.

- These are: lawyers, solicitors, accountants, doctor, pharmacist, anesthetists, dentist, physiotherapists, surgeons to name a few.

- Keep in mind that you may need to meet other criteria to get this deal and there will often be conditions to the loan as well.

#4: Having help with a family guarantee:

- This is where a family member has sufficient equity in their home or investment property and they want to help you out with buying your home.

- The family member then commits to provide the required equity as a security guarantee.

- For example, if you have 10% as a deposit yourself, then your family can provide the remaining 10% to make up the required 20% to avoid paying LMI.

#5: Get a loan ‘special promotion’

- From time to time some lenders will run promotions to target a certain type of loan. The most common promotion is to reduce the threshold to 15% rather than the 20% (i.e. if borrowing $500,000 you need a $75,000 deposit instead).

- Citibank are one of the lenders that offer this the most consistently.

- There are often other requirements to take this promotion, such as you need to pay principle and interest repayments (rather than interest only), they charge a higher interest rate on these loans and they restrict the type of property and the postcode that you’re buying in.

There are 5 ways to avoid paying Lenders Mortgage Insurance when you do not have a 20% deposit saved.

How can I reduce the amount of LMI I am paying?

For many people, it’s really challenging to save the full 20% deposit to avoid paying LMI – especially when you’re buying your first home.

For example, let’s say you’re buying your first home and it’s a 3 bedroom Queenslander in Greenslopes at a price of $620,000.

A 20% deposit on this property would be $125,000, plus buying costs like stamp duty, solicitor’s fee’s etc.

This can be very difficult for most people to save upfront.

The good news is, there are still ways you can save money by reducing your LMI premium.

The three big ways I reduce LMI are:

#1. Find an LMI sweet spot (this is the main one):

- When I run different deposit / loan amounts I find the sweet spot, which is where if a client reduces their loan by a small amount (a few thousand dollars), their LMI premium also drops by more than a few thousand dollars. I cover this one in more detail below.

#2. Consider using other lenders with lower LMI premiums:

- All lenders charge different premiums so you could save several thousand dollars difference.

#3: Don’t cross collateralize your loans

- If you have loans for both your home and your investment property, don’t have them both with the same lender.

A reminder that you can avoid paying LMI by taking advantage of the First Home Loan Deposit Scheme.

#1: Find an LMI sweet spot: How to save on lenders mortgage insurance

‘LMI Sweet Spots’ came about after analysing lots and lots of different LMI quotes and scenarios for clients to work out how to save them money on their LMI premium.

What I discovered was that in certain circumstances, if you increase your deposit by a small amount (and hence decrease how much you borrow), it can make a really big difference in the cost of LMI.

I’m not talking about increasing your deposit by $20,000 – most people wouldn’t be able to save or find that amount of money quickly!

Instead, I’m talking about increasing your deposit by few thousands of dollars to save double that!

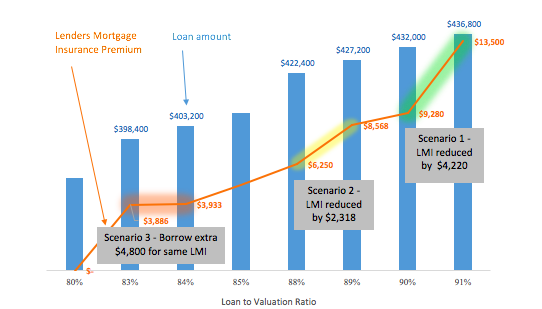

The best way to show you this is through the chart below. If you aren’t a graph or numbers person, don’t be put off. I’ll take you through a simple example.

The loan amount is the blue bar.

The lender’s mortgage insurance payable at that loan amount is shown by the orange line.

You can see that I have highlighted three sections in orange, yellow and green.

These are some examples of ‘sweet spots’ where you can save on your lender’s mortgage insurance.

The best sweet spots happen at LVR’s of 88%, 90% and 92%.

Let’s look at a scenario where we recommend an LVR of 90%.

#Scenario 1 (green): LMI premium reduced, saving the client $4,220

A client comes to me wanting to buy a home for $480,000.

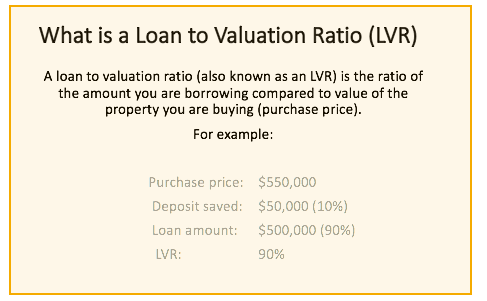

They have a deposit saved of $43,200, so they need to borrow $436,800 with an LVR of 91% (read about LVR’s in the callout box above).

At this deposit and loan amount, the LMI they need to pay is $13,500.

Recommendation:

After running these scenarios with a client to investigate we can show what the repayments and LMI cost would be if they have a slightly larger deposit ($4800 in this case). Now that they understand how it works and how their repayments would be lower they can see if it’s worth waiting a little bit longer for their savings to increase.

Lenders Mortgage Insurance

This means their deposit needs to be $48,000 (not $43,200).

This reduced their LMI premium to $9,280 (saving them $4,220).

By putting in the extra $4,800 in deposit, this client ended up borrowing $8,820 less overall (extra deposit of $4,800 + LMI saving of $4,220).

*** Borrowing less means their repayments are also $11 less per week. So let’s say you took out the second option but paid the $526 in repayments – this means you will pay your loan off 1 year and 4 months sooner than you would have otherwise.***

Wrap up: It’s worth considering different LVR’s (deposit to loan ration) to see how tweaking a few numbers here and there can actually save you several thousand in LMI. You will also reduce how much you borrow and lower your loan repayments overall.

Scenario’s 2 and 3 coming shortly in bonus material!

*Based on principle and interest repayments at an interest rate of 4.5% over 30 years.

A client saved $4,220 on their LMI premium.

#2. Consider using other lenders with lower LMI premiums: how to save on your LMI premium

Simply by changing lenders, you can save hundreds.

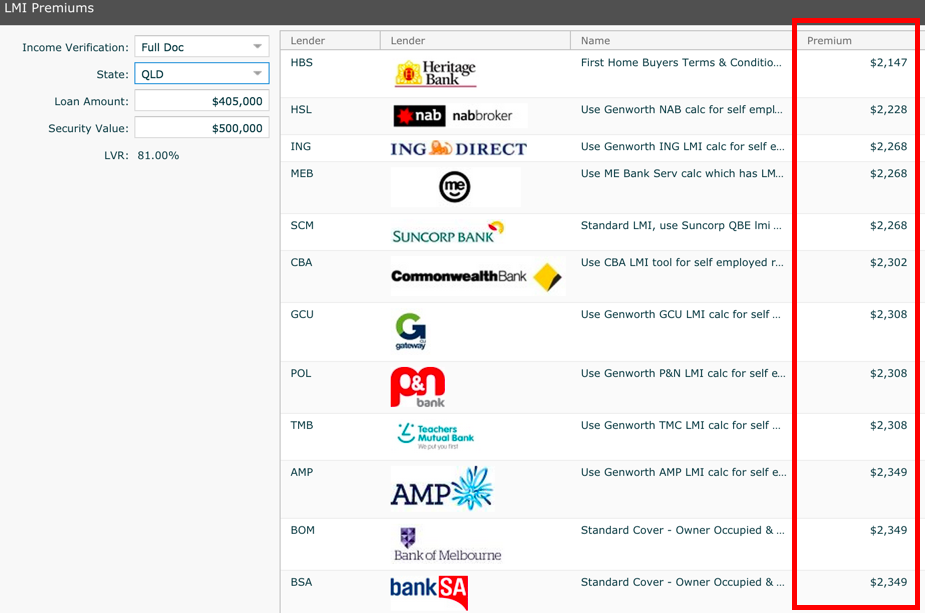

Looking at the table below, this client wanted to buy a home worth $500,000.

They had a $95,000 deposit, so wanted to borrow $405,000 (LVR 81%).

If this client took their loan out with Commonwealth Bank, the LMI premium would be $2,302.

The cheapest LMI premium is with Heritage Bank at $2,147 and the highest is $2,349 which is offered by several lenders including AMP and Bank of SA.

Save several hundred dollars on LMI by changing lenders.

How does LMI protect the lender

If you stop making your loan repayments, the lender will take ‘possession’ of your property (this term is known as ‘mortgagee in possession’) and sell it to regain the money they loaned you.

Sometimes, there is a shortfall between what the property sells for, and what you owe the bank.

In order to sell your property, your lender will have to pay a number of fees and expenses: real estate agent and legal fees, which the lender needs to cover.

In this situation (when the lender is out of pocket), the lender will claim on your Lenders Mortgage Insurance to protect them from losses.

Who provides LMI?

There are 2 main providers of LMI in Australia, or alternatively, some lenders provide their own LMI as well.

Two main providers of LMI:

- Genworth (sometimes referred to as GE): for example: The CBA, NAB, Bank of Queensland and Westpac use Genworth as their mortgage insurer;

- QBE Insurance: (Used by ANZ, Suncorp and BankWest.)

Each of these providers can have different policies relating to how and who they provide mortgage insurance too and the rates that they charge.

The LMI premium you pay is worked out between the insurance providers and the lender you are borrowing with.

This is why LMI premiums can vary by up to thousands of dollars.

Or alternatively, some lenders provide their own insurance (they will call it a different name but it essentially serves the same purpose ) and again there are large variations in what premium they charge (up to several thousand dollars).

When we’re recommending suitable home loans for your situation we are also taking into account the cost of the LMI as well.

My name is Victor Kalinowski, and I’m a Mortgage Broker at Blackk Mortgage Brokers, based in Brisbane. If you are interested in getting in touch, email me at [email protected] or call the office Monday to Friday on 07 3122 3628.

The information contained within this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2023.