The Queensland State Government helps out First Home Buyers with the Stamp Duty Concession.

The QLD Stamp Duty Concession (or Rebate) is where a First Home Buyer can save up too $8,750 in buying costs, when purchasing their first home in Queensland.

It is available when buying an established home valued at under $550,000, or, a block of land valued at under $400,000.

This post has been updated for 2021, and explains how you can maximise your stamp duty concession and what the eligibility criteria is.

What is the First Home Buyers Stamp Duty Concession?

Stamp duty is a tax paid by the buyer of a property.

Stamp duty can be a substantial additional cost of buying a property so the Queensland government has decided to help first home buyers out by giving them a exemption on all or part of the cost of the stamp duty.

It’s similar to the vehicle stamp duty you pay when registering/transferring the registration if buying a car.

The concession is based on whether you are buying an existing dwelling (i.e. one that has already been lived in) or you are building a new home.

It also changes depending on the value of the property.

Can I get any other Government benefits as a First Home Buyer in QLD?

There are currently three main programs on offer for first home buyers in QLD.

The easiest way to see what Government programs you are eligible for is by doing this short 1 minute Quiz.

- Queensland Stamp Duty Rebate/ Concession – (covered in this post) up to $8,750 if you are buying an established or newly built home priced at $550,000 or under. The Concession also works if you’re buying a block of vacant land for under $400,000 where you can get a Rebate of up to $7,175.

- Queensland First Home Buyers Grant – a $15,000 grant if you’re building a new home or buying a brand new home.

- First Home Loan Deposit Scheme / New Home Guarantee – a federal government initiative from 1 January 2020, where you can take out a mortgage with just a 5% deposit and avoid paying Lenders Mortgage Insurance.

Buying an existing home

How much do I save from the QLD First Home Buyers Stamp Duty Concession?

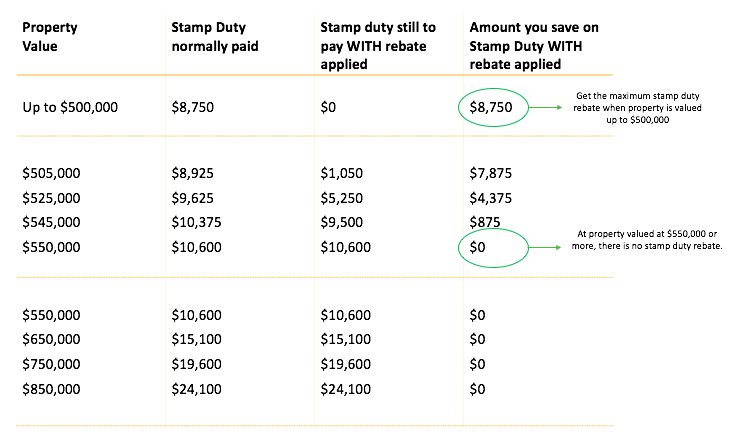

The maximum QLD First Home Buyers Stamp Duty Concession you are entitled to receive is $8,750.

The amount you get in Concession differs depending on the price of the property you are buying.

- Properties valued up to $500,000

- Concession is $8,750 (the maximum Concession you can get).

- Properties valued at between $500,000 to $550,000:

- You’ll pay some stamp duty but the reduction in costs is at a reduced rate

- For example, a property valued at $ 505,000: the stamp duty you would normally pay is $8,925. With the Concession you would only pay $1,050 (a saving of $7,875);

- Purchase price $550,000 or more:

- Once the purchase price is $550,000 or higher, the first home buyer Concession cuts out so you’ll be charged the same stamp duty as you would if you were buying a home as a normal owner-occupier.

- For example, if you’re buying a house valued at $ 550,000; you would pay $10,600 in stamp duty.

Queensland Stamp Duty Rates

The QLD stamp duty rebate cuts out at properties valued at $550,000 or more.

What is the eligibility criteria to get the QLD First Home Buyers Stamp Duty Concession?

When buying an existing dwelling (an already built house, unit, apartment, townhouse), the eligibility criteria is as follows:

- No previous ownership of residential land/property

- Have never held an interest in residential land anywhere in the world;

- Have never claimed the first home vacant land concession;

- You can’t have owned or part-owned any property in the past.

If you are buying with a partner who has owned property before, only the person who is the first home buyer can claim their portion of the concession. If you own the property 50/50, you are entitled to 50% of the concession.

2. Live in the property for at least 1 year / 12 months and;

- You’ll need to live in the property on a daily basis, for a period of at least 12 consecutive months;

- You need to move into the property with your personal belongings;

- AND that year needs to commence within 12 months of the date of property settlement.

- If you don’t you’ll need to be payback either part or all of your Concession.

3. Age and Citizenship / Residency;

- You must be at least 18 years old at the date of the purchase

- Permanent resident in Australia / Australian citizen. If you aren’t, you are still eligible for the concession, however, there is an additional levy payable called the Additional Foreign Acquirer Duty (AFAD) which is levied at 3% of the purchase price.

The QLD Stamp Duty Rebate is available on homes up to the value of $550,000 or on vacant land valued up to $400,000.

Can I claim the First Home Buyers Concession if the place I am buying is already rented?

If you are buying a home which is already rented and there are currently paying tenants with a lease, then you can let that property stay rented under the current lease end date or 6 months from settlement – whichever occurs first.

Then you can move in for your full consecutive 12 months, so you can claim your concession.

However, you can’t claim the concession if:

- You decide to extend or renew the lease of the current tenants past that 6 months date after settlement;

- If you buy a home which you want to live in at some point and decide to rent it out first beforehand.

What happens if the property I’m buying is occupied by an owner?

A useful bonus of the stamp duty Concession can apply where the property you’re buying is already someone’s home but they need some time to be able to leave.

We’ve found that this can work especially well in 2 situations:

- If the seller is moving into a nursing home or aged care facility and they need the money from their sale to you to allow them to buy the new property; or

- If the person you’re buying off is building their new home and they need time for the builder to finish building their new home before they can move in. If it suits all parties you can negotiate for the current owner to rent the property off you for a maximum of 6 months from the settlement date without impacting the concession grant if you then move into the property for a year.

How to take advantage of this

Knowing this can be really advantageous in certain situations. Let’s say you’re renting and your landlord is flexible about when you leave.

Let’s also say that you’re looking to buy a property from a person who needs the money from the sale of their property BEFORE they can buy their next property. You may be able to negotiate it that they can rent your property for 5 months after settlement which gives them time to buy a new home without having to move.

This is a massive help when you’re negotiating in a competitive environment and could give you a big advantage over everyone else who’s home hunting!!

If you have any hesitation it’s best to the QLD Office of State Revenue directly on 1300 300 734 and talk with them about your personal situation.

You can claim a stamp duty Concession if buying vacant land to build. (Pic – Holland Park, Brisbane).

Buying vacant land and building a home

How much do I save with the QLD First Home Buyers Stamp Duty Concession?

The concession is based on the value of the vacant land you are buying (not the building, as this is covered by the $15,000 first home buyer grant).

For example, if the purchase price is:

- Up to $250,000:

- The full concession applies and you won’t be charged the stamp duty providing your application is approved;

- On a land purchase of $250,000, this is an immediate saving of $7,175.

- Between $250,000 to $400,000:

- There is a reduced Concession so you will pay some stamp duty.

- For example on a land purchase of:

- $ 260,000; the stamp duty you would normally pay is $7,525. With the Concession you would only pay $825 (a saving of $6,700);

- $ 300,000; the stamp duty you would normally pay is $8,925. With the Concession you would only pay $4,125 (a saving of $4,800);

- $400,000; the stamp duty Concession does not apply, so you would need to save $12,425.

- Purchase price $400,000 or more:

- Once the purchase price is $400,000 or higher, the concession cuts out so you’ll be charged the stamp duty

- For example, if you’re buying a house valued at $400,000; you would pay $12,425 in stamp duty.

- Once the purchase price is $400,000 or higher, the concession cuts out so you’ll be charged the stamp duty

If you are building a home, you’ll only need to consider the stamp duty on the land purchase. Stamp duty isn’t payable on the actual build of your home and any extras (i.e. driveways, fencing, landscaping, solar panels etc).

What is the eligibility criteria to get the QLD First Home Buyers Stamp Duty Concession?

When buying vacant land and building a home, the eligibility criteria is as follows:

- No previous ownership of residential land/property

- Have never held an interest in residential land anywhere in the world;

- Have never claimed the first home vacant land concession;

- You can’t have owned or part-owned any property in the past;

- Be paying market value if the vacant land is valued between $320,001 and $399,999.

If you are buying with a partner who has owned property before, only the person who is the first home buyer can claim their portion of the concession. If you own the property 50/50, you are entitled to 50% of the Concession.

2. Build your first home on the land, and:

- Move in with your personal belongings;

- Live there on a daily basis;

- Move in within 2 years of the land settlement;

- Only build 1 home on the land (there must not be any building or part building on the land when you acquire it);

- You’ll need to live in the property for a period of at least 12 consecutive months;

- If you don’t you’ll need to be payback either part or all of your Concession.

4. Age and Citizenship/Residency:

- You must be at least 18 years old at the date of the purchase;

- Permanent resident in Australia / Australian citizen. If you aren’t, you are still eligible for the concession, however, there is an additional levy payable called the Additional Foreign Acquirer Duty (AFAD) which is levied at 3% of the purchase price.

When do you receive the Queensland First Home Buyers Stamp Duty Concession?

The stamp duty concession is calculated just before settlement by your solicitor or conveyancer (the settlement date is the date on which the property officially becomes yours and you pick up the keys).

Your solicitor or conveyancer calculates the costs of buying which includes stamp duty, rates etc, so your concession is taken into account here.

If you do need to pay stamp duty, it is your solicitor’s responsibility to notify you of this and they will work out the amount you need to pay.

Your solicitor/conveyancer should tell you at least a few days prior to settlement what you owe, so you can give the funds to them or banked them in your account at least 2 business days prior to settlement.

If you’d like to understand what is involved in building a new home or buying a home check out these posts to find out more.

How do I maximise my entitlement to the QLD First Home Buyers Stamp Duty Concession?

The Concession increases the more you pay for your property, up to a capped amount.

You can claim the maximum Concession if the cost of your property is just under capped amount allowed.

The stamp duty Concessions are different depending on whether you are buying vacant land or an established dwelling. If buying:

- An established dwelling – the maximum Stamp Duty Concession you are entitled to is $8,750 if you spend $499,999;

- Vacant land – the maximum Stamp Duty Concession you are entitled to is $7,175 if you spend $249,999.

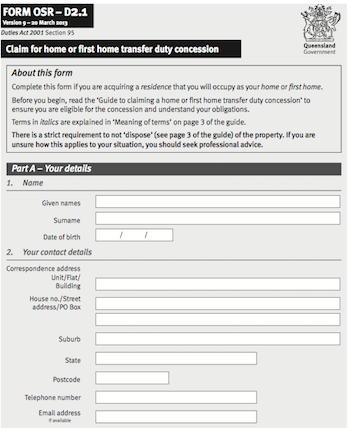

How to apply or claim your Queensland First Home Buyers Stamp Duty Concession

Your solicitor or conveyancer will complete these forms with you.

You can view these forms here.

My name is Victor Kalinowski and I’m a mortgage broker at Blackk Mortgage Brokers, with offices based in West End (Brisbane) and Burleigh Heads (Gold Coast). I help clients from all over Australia buy homes.

If you’re interested in getting in touch for some advice, book a call, instantly, at a suitable time or call 07 3122 3628.

![]()

The information contained within this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2023.