Rents are higher and home values trending lower creating a window of opportunity to buy an investment property.

If you have been considering buying an investment property then I think now could actually be a good time to jump in and buy it.

While there has been a lot of focus and attention on rising interest rates the truth of the matter is they are still at a very manageable level.

The shock has come from them being at historically rock bottom levels.

We have noticed that there is a lot of positive data in the market at the moment.

So now might be a good time to take advantage of negotiating to buy your first or second or even third investment property.

What I am seeing are a few factors working in your favour right now, so let’s discuss these.

You can also listen on YouTube here if you prefer.

Listen on youtube as I discuss why right now there may be a window of opportunity to buy an investment property.

Equity in your home after years of price growth.

If you’ve owned your home for a few years, with the strong increase in property prices in recent times your property will have increased in value.

With this in mind there, is a good chance you’ve built up some substantial equity in your home.

You can look to access the ‘usable equity’ as this can now be used as a valuable resource as it acts acts as a security on your investment property.

It’s important to know that you do not need to have paid off your mortgage to access your equity.

In this example here, your equity is $300,000, however your usable equity (what you can use to form a part of your deposit to buy an investment property) is $100,000.

Read this guide if you want to know more about how to use your equity to buy an investment property.

If you have no equity or deposit saved, you can still buy an investment property as I cover in this guide here.

More demand for rental properties so rents rise.

Right now there is more demand than ever for rental properties as vacancy rates remain at record lows across Australia and particularly in south east Queensland.

Core Logic has reported that in Greater Brisbane, we are seeing a vacancy rate of 1%, which is well below the 5 year average of 2.8%.

There are only a very small number of properties available to rent, which is pushing rents up. It’s part of the story as to why I think now is a good time to buy an investment property.

There are a lot of pro’s in terms of this demand and your property is likely to be rented out quickly.

An added bonus is the rental shortage is also driving up weekly rents allowing investors to cover their costs associated with an investment property.

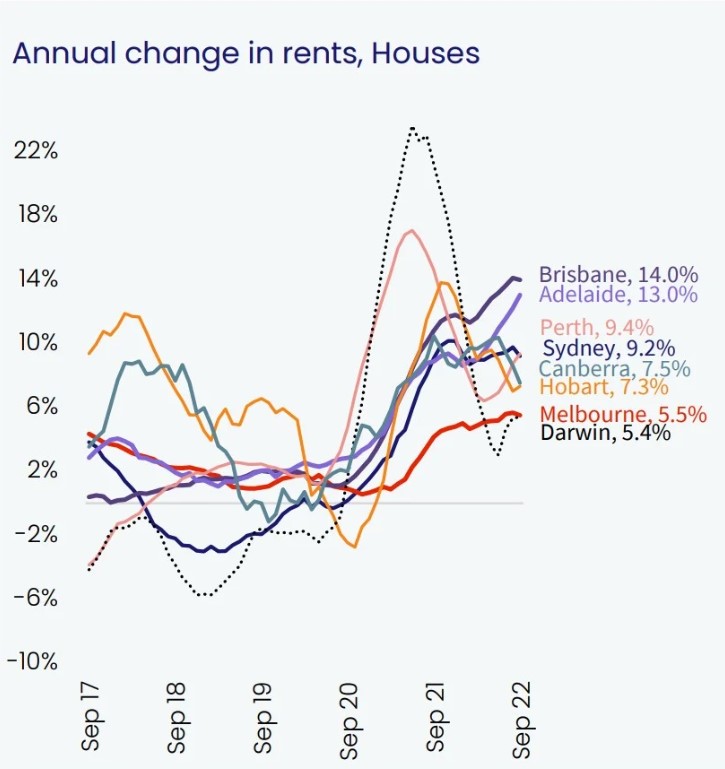

Recently Core Logic reported that in Brisbane, house rents increased 14% in the last 12 months (September 2022 YOY) where as unit rents increased 11.9% in the same time.

We are seeing this trend on the Sunshine Coast too. A client had rented their property for $430 per week over the last 12 months and as of October 2022 the agent is proposing a rental income for the new tenancy at $550 to $585 per week.

What all this means is that a lack of rental properties plus rising rents will put your rental property in a really good position, even with rising interest rates.

House rents increased 14% in September 2022 V September 2021. Source: CoreLogic.

It’s interesting also to keep an eye on what is going on with migration to Australia.

Over COVID we saw no migration and we also lost over 500,000 temporary Visa workers.

And what follows shortages are gluts.

The Labour government are now talking about boosting migration, probably to levels we have never seen before, over the next few years.

And of course new arrivals to Australia are overwhelmingly renters, especially initially.

House prices are on a slow decline but for how long?

The CoreLogic NAB weekly house price heatmap has shown that for this week (2 October 2022), Brisbane-Gold Coast prices were down -0.1% compared to the same time the previous month and down -4.4% compared to three months ago.

These declines were triggered by the RBA cash rate rises that started in May 2022 have continued through to October, with one more rate rise expected in November, at which point the RBA will have till February 2023 to see what impact it has had.

In terms of when it is the best time to buy, it is hard to predict the bottom of the market.

Except I will say that by the time this has been reported on, the market will have already swung upwards.

I would not be expecting a flood of homes at rock bottom prices to hit the market at any time.

There is really no evidence in the banking loan books of forced sellers and really, mortgage arrears are at record lows.

We know that with employment so high, people can get a second job, reduce discretionary spending or switch to interest only repayments to repay their mortgage if they are under mortgage stress.

I suspect this slow decline may continue, possibly at least into the new year as buyers are now only just feeling the impact of several rate rises, with possibly still one more to come in November 2022.

It’s easier to get your offer to buy accepted in the current market.

Throughout 2021 and into 2022, I have reported many times on how difficult it has been for our clients to get an offer on a home accepted.

There were simply more buyers than number of houses for sale.

We saw properties being sold after the first open for inspection and we had that onslaught of buyers from NSW and VIC making cash offers which were irresistible to vendors.

As I said on my September 2022 market update – this is no longer the case.

The market has certainly changed.

Now we are seeing a change in the market with many houses on the market only receiving one or two offers, so it’s much less competitive.

Houses are remaining on the market for longer and agents and sellers are prepared to negotiate.

What I recommend you do now.

This is the chance to stay calm and take advantage of the uncertainty out there.

Everyone I’m talking to at the moment is finding that things are different to a few months ago.

I think there may be a window of opportunity right now, if you are in a position to do so.

It used to be about the ‘Fear of missing out’ and now it’s a bit of the opposite really, the ‘Fear of getting in early’.

It is certainly harder for people to get bigger loans approved as the rate rises are reducing your borrowing capacity.

So really, what I am seeing is that it’s easier to get an offer on a property accepted – but harder to get the finance approved.

Buying an investment property is really more of a game of getting your finance sorted, rather than bricks and mortar.

It’s important to work with an investment savvy mortgage broker who can advise you and get your loan approved – strategic property investors certainly do.

The type of advice we give helps investors optimise what they can borrow and plan for changes in the market, for example by having financial buffers.

My name is Victor Kalinowski and I’m a mortgage broker at Blackk Mortgage Brokers, and we help people buy property all over Australia. We can do this all via video calls or we have offices based in West End (Brisbane) and Burleigh Heads (Gold Coast).

The information contained on this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2023.