Learn advanced strategies and tools in this 12 steps guide to getting your offer accepted.

Buying property is something we only do occasionally, at most, in our lives.

Yet knowing how to make an offer on a house, below the asking price, can make a huge difference to any future capital gains.

If you are spending your Saturdays at open homes and are at the point where you are wanting to make an offer, you may be feeling daunted about how to go about it.

Perhaps you have already been through some disappointments missing out on places that you love.

This guide makes knowing how to make an offer on a house and getting yourself through to settlement, super simple to follow.

I share the real scenarios, strategies, and tools that I use to help clients come up with and get their offer to buy a home accepted.

If you don’t have time to read the full Guide now, download the summary version now.

1. Research what the house is worth.

How much should I offer on a house? That is the question. If you go to lots of open homes and keep up to date with what is being bought and sold in your area, then you will have a very good idea of the market value of any home you are seriously considering buying.

If you want to do a little more research to be sure you aren’t overpaying on the property, have a look at these three strategies.

In this post, I recommend that you physically look at 20 or more properties in the area, which are similar to the one you are considering, over a 6 month period.

You can also use RP Data reports and sold properties on realestate.com.au.

By doing the research, you will feel confident that you are not overpaying. The vendor may have unrealistic price expectations so even though you are offering what seems to be market price, you still may not get your offer accepted.

Check out my post on how to do your house price research to make sure you are not overpaying.

Check out my post on how to do your house price research to make sure you are not overpaying.

2. Find out why the vendor is selling and solve their problem.

One of the most important strategies you will learn in this guide is the knowledge that price is not the only lever you have when you go to negotiate buying a home.

Nearly everyone focuses on the dollar value when making an offer, but the key is in the terms and conditions you offer.

If you can find out why the vendor is selling, it will help you to come up with ‘conditions’ that make your offer appealing by solving a ‘problem’ for the vendor.

For example, if the vendor is selling due to a relationship breakdown and there are children involved, then often you find one of the parents is living in the house with the kids, and the other parent is renting elsewhere.

In this situation, a short finance and settlement period with your offer would be favourable.

The vendors can receive the proceeds from the sale and move on quickly.

You may also find that the parent living in the home with the children, would appreciate renting the home back from you for say 2 months, while they find somewhere else to buy.

If you present your offer to buy, with these conditions, you have a greater chance of your offer being accepted over other offers, even if your offer is lower in price.

Here I cover the top 5 most common reasons a vendor is selling and how you can adjust your terms and conditions to get your offer accepted below the asking price.

Make sure you check out my video series on finding out the reason a vendor is selling their home and then how to tailor your offer around this, to get it accepted. [Pic – Victor Kalinowski in the South Brisbane office].

3. Make sure you can get a home loan approved

If you are talking seriously to a real estate agent, one of the first questions they will ask you is “do you have your finances in order”?

They want to know you are a serious buyer.

When you start to negotiate the house price, you will want to have complete confidence in knowing:

- Will the bank lend you money;

- What is the maximum amount you can afford to borrow and repay;

- How long will it take to get unconditional loan approval;

- How to make an offer on a house.

Be aware that in 2025, it has become much harder to get home loans approved, so I do not recommend entering into any negotiations to buy a house until you know where you stand financially.

It is best to have a talk with us before you start looking for a home, and certainly well before you go to make an offer on a home.

Want to know more? book a free 15 minute strategy call with me here to talk about how we can get your home loan approved so you can confidently make an offer.

We have a reputation in the industry for getting home loans approved. In fact, 99% of the home loans we applied for on behalf of our clients were approved in the last 12 months. This comes down to Victor’s superior banking knowledge and thorough process for understanding your finances.

4. Ask the real estate agent how they would like the offer made.

In Queensland, there is no standard way to make an offer to buy a home.

You will need to talk to the real estate agent about how they are receiving offers on the property, with the common approaches being:

- Put your offer in writing in an email;

- Take a verbal offer over the phone;

- Fill out a form;

- Complete an ‘expression of interest’;

- Complete the ‘contract of sale’.

In order to make an offer on a house, you will need to determine the amount you should offer and the conditions that complete your offer.

How to make an offer on a house – before you make an offer to buy a property, talk to the agent about how they are taking offers. In QLD there is no standard way to do this.

How to Make an Offer on a House – Making an Offer on a Property in QLD

Now you know how the real estate agent is accepting offers, you will need to provide the agent with all the information they require, in order to officially receive your ‘offer’.

This information is generally copied over into the ‘contract of sale’, when your offer is accepted (or sooner depending on the agent).

5. Talk to a Mortgage Broker so you can finalise your offer.

Once you have had your offer accepted, get in touch with your mortgage broker straight away so they can officially kick off the process of getting your home loan approved.

If you have already spoken to your mortgage broker, before making an offer, you may already have this information.

Either way, your broker will be able to advise:

- Confirm your ‘finance date’ – meaning when we think we can get your home loan unconditionally approved. Generally allow 3 weeks for this, or 4 weeks if it is a family guarantee home loan (this information is needed for when you go to make an offer);

- How much deposit you can put down to secure your offer (this information is needed for when you go to make an offer);

- How much you are prepared to pay for the property;

- Give you an overview of the process to buy a property

- Talk to you about how to make an offer on a house; and

- How to get ready to apply for your home loan.

This session with me ensures you are feeling confident and informed about what is to come.

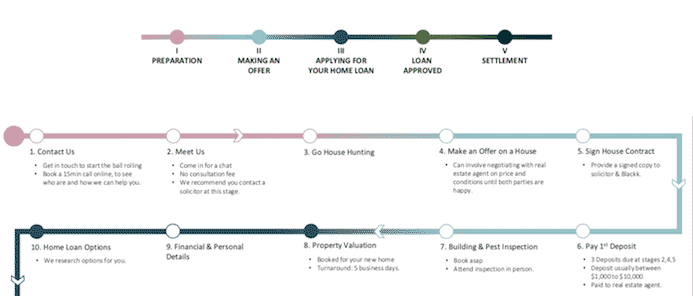

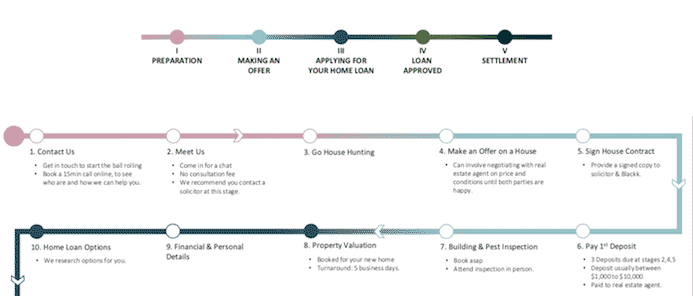

This post covers how to buy a house in more detail, and within the post, you can download this step by step map (shown below) which guides you through all the steps required to get a home loan approved and settle on the property.

We have mapped the steps you need to take to buy a home.

6. Prepare your offer and conditions.

An offer on a property is made up of two features:

- Price – what you are prepared to pay for the property;

- Terms and conditions – also known as clauses, which are the terms around your offer, and help protect both you and the vendor.

It is common that vendors have an unrealistic expectation of what their house is worth.

If you have done your research, you will have a much better idea of the value of the property than the vendor and often even the real estate agent.

Your initial offer should be within 5% to 10% below what you are prepared to pay, to give you some room for negotiation.

For example, if the property you want to buy is on the market for $550,000, then your first offer would be around $520,000.

Keep in mind though that there may be other buyers, so starting low may mean you miss out.

When you have found a home you love, let us show you how to make an offer and successfully buy all the way through to settlement.

Deciding on the ‘conditions’ of your offer

‘Conditions’ are usually focused on the ‘time frame’ for when you move in and allow you to ‘get out of the sale’ if your finance falls through.

It is important that you get these conditions right upfront as if you try to add these conditions into the contract after it has been finalised, then it’s unlikely the vendor will agree.

A savvy buyer who has done their research will be armed with information on why the vendor is selling and where possible,

use this information to customise the terms and conditions.

The aim is to resolve a problem the vendor has and to make your offer a hard one to refuse, even with a lower price.

It is important that you talk to a solicitor or conveyancer about the conditions you are requesting along with your offer before you sign the contract of sale.

A solicitor will be able to advise you on the exact wording of the conditions to include and their implications.

Once you have your complete offer ready – ‘price’ and ‘terms and conditions’ – you then submit this to the real estate agent.

Talk to a solicitor about the house contract before you sign it. You can also read my guide to the terms and conditions I personally use in a contract.

7. Think about your counter-offer

The agent will usually come back to you with an answer within a day or two of you submitting your offer.

They may accept your offer and conditions as is – or more likely – they will come back with a counter-offer.

Usually, the vendor will want to increase the price and potentially reduce the time frames for the finance period and the settlement date.

This is because the vendor wants certainty as soon as possible that you will purchase the property.

The actual negotiation can go back and forth for days and even up to a week or more.

I have seen clients putting in counteroffers up to six times before both parties agree.

Submitting a counteroffer

The way you submit your counteroffer will usually be the same as the way you submitted your original offer.

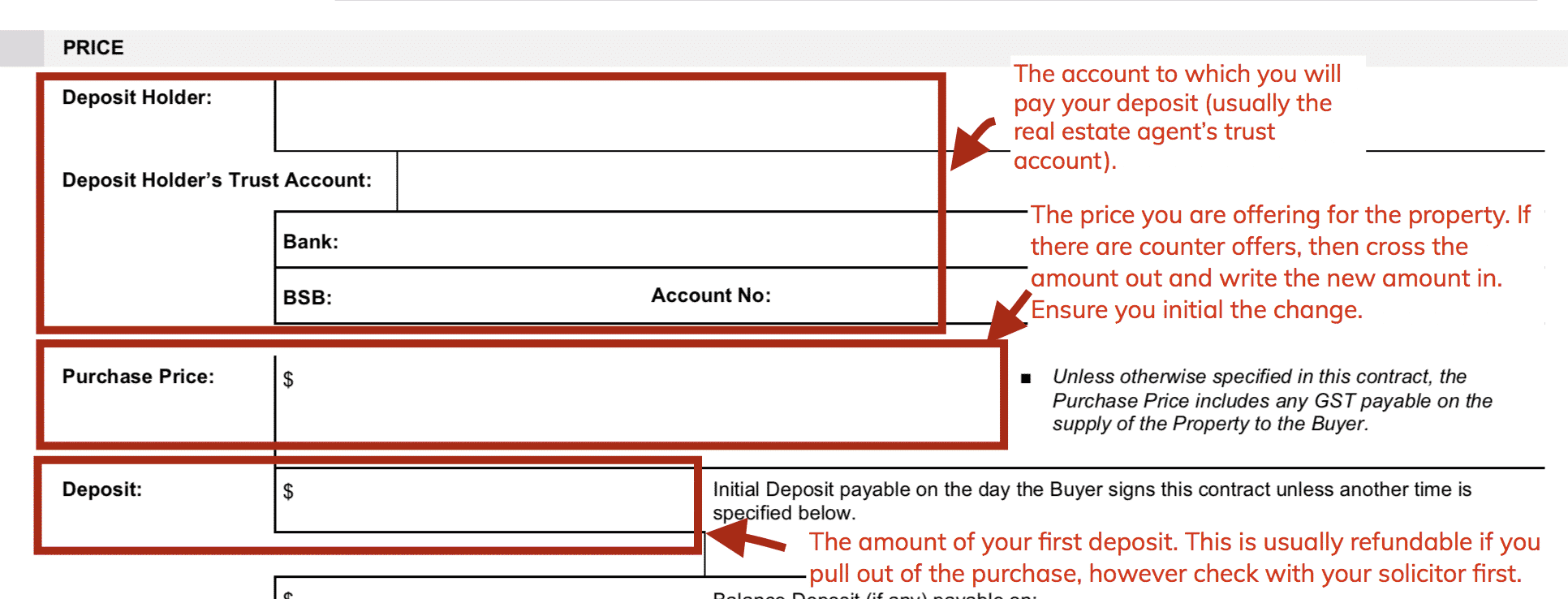

If you are already working with the ‘contract of sale’, then you need to cross out the price on the contract and write in the new price in each time you make a counteroffer (plus initial the change).

The agent will guide you through this.

The negotiation will go back and forth until you both reach a price and conditions that you are happy with.

The back and forth negotiation that happens when you have made an offer on a home you love is nerve-wracking for everyone ??. Let us guide you through this ?.

How to make an offer on a house bonus strategy: how to handle a negotiation when you are first to make an offer on a property that is overpriced.

If you are the first to make an offer on a newly listed home, and your offer is priced below what the vendor is asking, then it is likely your offer will be rejected.

Sometimes vendors have unrealistic exceptions of what their home is worth, and it can be hard trying to break their expectations.

This is the point where some people, especially first home buyers, get disheartened – no one likes a knockback.

In this situation, I would advise you to keep an eye on this property.

If the vendor’s asking price is truly overpriced, then it is unlikely to sell.

Over the next few weeks and months, several other buyers may also put in offers that could be rejected too.

Over time this process will start to break the vendor’s expectations on what the property is worth.

You may be able to go back in with an offer that is close to your original offer and have it accepted.

There are many different ways a negotiation can play out and several different strategies you can use, so it’s best to discuss this with me as you are going though it.

8. Sign the ‘contract of sale’ or ‘expression of interest’.

Once your offer has been accepted, the real estate agent will complete the ‘contract of sale’ so you can sign it (you may have already signed the contract of sale).

You will need to check all details in the contract of sale to ensure they are accurate.

There is no room for error here.

Pay particular attention to:

- The spelling of your names – they must appear as they are on your passport or drivers license, including middle name;

- Price and conditions – are as you stated in your offer.

How to make an offer on a house – this is a snippet from my overview of the REIQ Contract of sale, so you can familiarise yourself with what it’s all about. Download the full contract with my notes here.

The contract of sale is a legally binding agreement between you and the owner of the property.

As mentioned, it is crucial you go through it with your own solicitor or conveyancer to ensure the contract is sound so the transaction can be completed successfully.

9. What to do once your offer has been accepted.

There are a number of steps you’ll need to take very quickly once your offer has been accepted.

See here the steps to buy a house which run through exactly what you need to do.

We have mapped the steps you need to take to buy a home which can be accessed here.

10. Consider if you need to negotiate a price reduction after seeing the building and pest report.

There can be all sorts of issues that can be picked up in a building and pest report.

Wet rot in the bathroom and kitchen cupboards, cracked glass windows, termites, and concrete cancer are just a few examples.

Most properties will have some wear and tear, especially if you are buying an older Queenslander.

Depending on how serious the issues are, you can use them as negotiation levers, after you’ve signed a contract of sale, such as by negotiating:

- A price reduction – which takes into account the cost of you fixing the issues once the property has settled (I recommend this over option 2);

- For the vendor to pay for and manage the repairs – and have the issues fixed before the property settles. You may or may not want to also negotiate a price reduction.

If you want to negotiate a price reduction or have the vendor fix the issues, it will help your cause to get at least one quote from a tradesman to estimate the cost of fixing the problem.

Use a bit of wisdom when negotiating.

Be aware that asking for a price reduction because of the building and pest report may not be well received by the vendor.

This is especially the case if you have already had your offer accepted for lower than the asking price.

If the price reduction is based on something that was obvious before you made an offer, like cracked windows, then it can be hard to get a price reduction.

It is fine to ask for a price reduction on issues that even the vendor was not aware of, like white ants.

Avoid pushing the vendor over the edge and having your offer rejected by exercising some wisdom in these situations.

Getting issues fixed

If there are issues which you want to be fixed, like white ants,

then I would recommend that you manage the repairs yourself with the tradespeople once you own the property (or even before settlement so it is fixed before you move in).

This way you can be sure of the quality of work.

Pulling out of the sale

If you are not comfortable with what is in the report, for example, there may be some serious structural concerns, the issues are too expensive to fix or you simply aren’t up for that type of renovation, then you can pull out of buying the property altogether.

This is why it is so important to have a building and pest clause as a condition in your contract of sale.

If you are negotiating based on your building and pest, I recommend you handle the repairs yourself rather than having the vendor do it.

How to make an offer on a house bonus strategy: leaving the building and pest clause out helped me buy this property.

A few years ago, I bought a run-down property in Ipswich, west of Brisbane.

From my property research, I knew that another buyer had already paid for a building and pest inspection, and as a result of what was in the report, they had pulled out of the sale.

The vendor had since come to terms with lowering the asking price and had received seven offers.

I decided to put an offer in as well, with an even lower asking price than what I thought the other offers were.

My offer was accepted.

What made my offer stand out from the crowd was that I had no clause for a building and pest inspection (meaning I would not pull out of the sale if I didn’t like the building and pet report) and I also had a short settlement.

I was able to use this strategy as I already knew what was in the building and pest report.

My lower offer took into consideration the cost to fix these issues, and I had made similar repairs to another property in the past.

I would not have used this strategy if I had:

- No renovating experience;

- Was borrowing more than 80% of the cost of the property; or

- Had no money to pay for the renovations.

Please get in touch if you want to discuss the issues in your building and pest report and how you might go about negating a price reduction.

I left the building and pest clause out of the contract, which helped me get my offer accepted over other bids. This strategy should only be used by experienced renovators with money behind them.

11. Have your home loan unconditionally approved.

Now that you have signed the contract, you will need to get your home loan unconditionally approved (also referred to as formal or final approval).

To see exactly what is involved in the steps to get your loan unconditionally approved, read how to buy a home.

12. Organise a pre-settlement inspection.

I recommend you include a clause in your contract of sale to do an inspection of the property before you take ownership at settlement.

It is worthwhile taking another look at your future home, just a few days before settlement day.

You will want to ensure the property is in the condition you expected.

If you also included a clause in the contract of sale to have the property professionally cleaned prior to settlement, make sure this has been completed to an acceptable standard.

To arrange the inspection, just contact the real estate agent a few days prior to settlement. If you want to learn more about how to make an offer on a house, remember that Google is not your only tool.

Please feel free to book a free 15 minute strategy call with me here.

I recommend you get some free advice along the way – book a free 15 minute call with me.

If you’re looking for a mortgage broker in Brisbane, contact Blackk Mortgage Brookers. If you’re at all unsure, please feel free to book a free 15-minute strategy call with me here at any time. There’s no catch.

Whether you’re looking at making an offer on a house or you need a refinance broker, I recommend you get some free advice along the way – book a free 15 minute call with me today and take the first steps towards your dream home.

The information contained within this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information, you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2025.