Get prepared for more rate rises with these 3 best ways to reduce your mortgage payments.

With all the hype in the media right now of how high interest rates might go, many of you may be starting to worry about your financial situation.

How much space do you have or can you create each month for rising rates?

How can you plan and stay ahead of it all (and avoid mortgage stress down the track)?

What we find is everyone is affected in a different way by these rate rises.

I recommend different strategies depending on the type of loan you have.

Ask yourself:

- How high is the interest rate you are paying on your home loan?

- Do you have multiple debts other than your home loan?

- Do you have investment property loans as well as your owner occupied loan?

You always want to be putting yourself into the best financial situation and now this is more relevant than ever.

I recently spoke to Channel Nine News on exactly this topic.

Below I go into more detail which we didn’t get the chance to cover on the news.

You can start benefiting from reduced mortgage payments now, so please go ahead and book a free call with me here to discuss your options.

In June 2022, I spoke to Channel Nine News on ways to get ahead of interest rate rises.

Strategy 1: Now is a great time to look at a lower variable rate home loan.

This strategy is for you if you have:

- An owner occupied home loan; AND

- You are on a variable rate OR you are coming off a fixed rate in the next 4 – 6 weeks; AND

- You have more than 20% equity in your property.

Key benefit:

- Based on the assumption that if we can lower the interest rate that you are currently on, then you are in a better situation if interest rates rise.

Earlier in the year when interest rates were at record lows, my newsletter commentary advised you in general against refinancing unless you had a very good reason to do so.

What I am recommending now, is that if you are interested in refinancing to a better variable rate home loan deal, then now could be a good time to this to save money.

Many banks, including the Big 4, are offering some of the sharpest variable rate home loans that I have seen in years (see the table below).

Switching to a lower variable rate now allows you to build yourself a buffer as rates continue to rise.

Of course before switching, it’s important to understand that as interest rates rise, people on variable home loans are more exposed to the current RBA rises.

However, at the same time the big benefit is that you will usually be protected by lower rates compared to being on a fixed loan.

Based on a $700,000 loan, with an LVR of less than 70% (as at 16 June 2022).

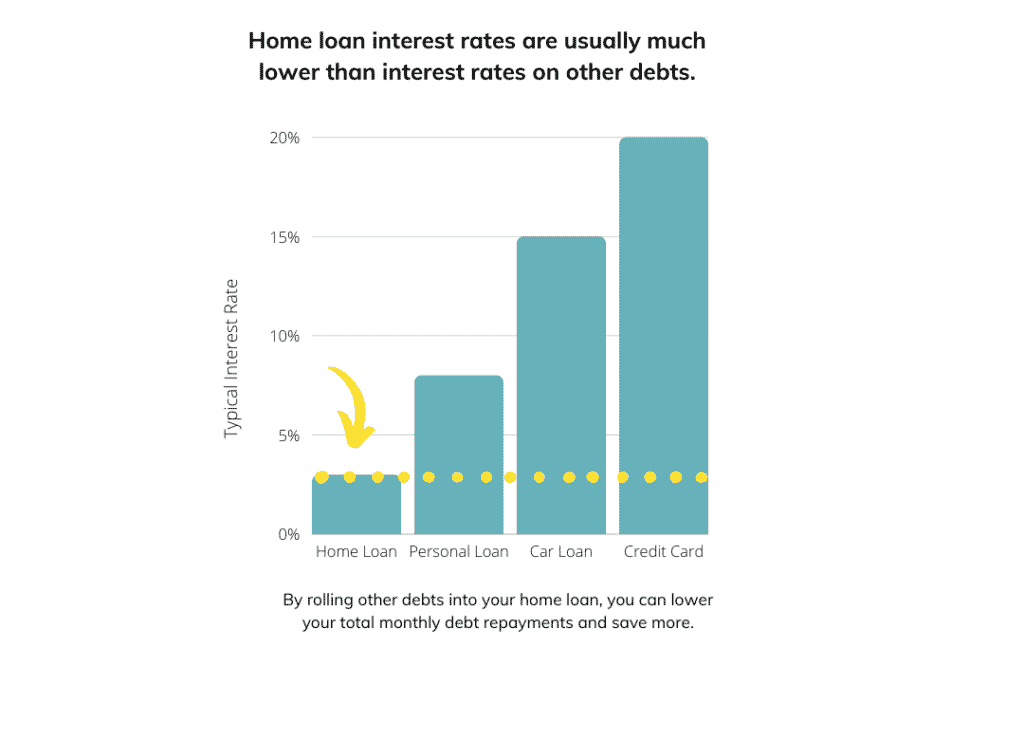

Strategy 2: Roll your debts into your home loan to save money.

This strategy is for you if you have:

- An owner occupied home loan; AND

- At least one or more other debts such as a credit card, car loan, personal loan, etc; AND

- You want to stay with your current bank, OR if you are refinancing you want to borrow less than 80% of the value of your home

Key benefit:

- This can save you money and improve your cash flow each month by lowering your total monthly debt repayment.

- Based on the assumption that we roll all debts into your home loan as it will have the lowest interest rate.

If you are looking for the most effective way to reduce your monthly expenses so you can save more, then rolling some or all your debt payments into your home loan might be the right strategy for you.

I see a lot of family budgets and I can tell you that it is quite common that the biggest fixed expenses each month are debt repayments.

Home loans, car loans and a maxed out credit card often can be the biggest chunk of fixed expenses.

As interest rates rise again, you may find yourself starting to feel concerned about how you will be able to afford all your monthly loan repayments.

The reason why this strategy saves you money is that you are likely paying a much higher rate of interest on your car loan, personal loan and credit cards – than you are on your home loan.

It is often that in terms of debt the lowest rate of interest is on your home loan.

By consolidating these loans into one loan (your home loan) it can reduce the amount of interest that you pay to the lenders overall and it also frees up your cash flow.

Read the full post here including how we saved one family $280 a week using this debt consolidation strategy.

Strategy 3: Why it’s a good time to consider an interest only investment loan.

This strategy is for you if you have an:

- Owner-occupied home loan; AND

- Investment property home loan; AND

- You are paying principal interest on both; AND

- You are coming off interest only in the next 4-6 weeks and need to renew it.

Key benefit:

- By making your investment property loan interest only, you can reduce your loan repayments considerably (sometimes by up to half).

- Keep your owner occupied home loan principal and interest.

Over the last few years with interest rates at record lows, higher rents and a strong property market many of our clients have bought investment properties to add to their portfolios.

It has been quite common for them to have principal and interest repayments on both their owner occupied home loan as well as the investment property loan.

In this situation they reduced their debt on both their loans.

We were able to get them lower interest rates as principal interest gets you a lower rate than interest only.

And under the market conditions, it has been manageable for most people to meet all their home and investment property loan repayments, without additional out of pocket payments.

A lot of people found with the low interest rates and the rents that their properties were cash flow positive which meant that they were basically paying for themselves.

This is changing…..

Now the challenge comes in as interest rates rise.

What I am recommending you do right now, is review how many rates rises you can take before your property becomes cash flow negative.

A strategy you can follow is to switch your investment loan to interest only to reduce the repayments on your investment debt, which may be able to reduce your repayments by up to half.

This is not so much going to save you interest because the interest rate will go up when you have an interest only loan, however it can significantly improve your cash flow and allow you to have more funds to focus on paying off your owner occupied loan.

If you think it will be something that helps, please don’t hesitate to get in touch.

You can read the full post here.

My name is Victor Kalinowski and I’m a mortgage broker at Blackk Mortgage Brokers, with offices based in West End (Brisbane) and Burleigh Heads (Gold Coast). If you’re interested in getting in touch for some advice, book a call instantly at a suitable time or call us on 07 3122 3628 today.

The information contained within this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2023.