Home Loans for Self Employed Individuals

2023 Complete Guide for Borrowers

Download the Guide

You may already know that as a business owner, getting a home loan approved can be tricky.

Banks see self employed people as a higher risk, than say your friend who works for the Government or a big corporate. As a fellow business owner I know that’s not the case as I have full control over my business succes.

So one of the approaches I use is to show case your business to the lenders in the way that makes sense to them. You’ll need to be getting prepared for this 6 to 12 months out from buying.

So whether your a tradesperson, content creator or profressional, in this guide I share the same advice I give my clients on how to get a home loan approved.

The Self Employed Home Loan Guide

Want a PDF copy of the full guide instantly emailed to you?

Chapter 1

Can a self employed person get a home loan?

Some business owners can buy a home or investment property straight away.

Others may need to work towards getting their finances organised so they meet bank requirements before applying for a home loan.

I also clear up what the definition of a self employed person is when it comes to mortgages.

Let’s start with some basics.

Yes you probably can get a home loan.

Whether you are wanting to refinance, or buy a home or investment property, the banks have tougher rules for the self employed.

It is actually easier for your employees to get a home loan than you, as the business owner.

Being a business owner myself, I know I have full control over how much money I make.

So surely, this means my income is actually more reliable?

Well lenders do not see it like this.

A person who is earning a salary from an employer (say your employees) is perceived by the lenders to have somewhat of a ‘guaranteed’ income.

By comparison, someone that is self-employed has an income that fluctuates so they are considered more of a ‘risk’ for the lender.

Before a lender approves your home loan, they thoroughly check your personal and business financials to ensure you can make home loan repayments well into the future.

This Guide gives you tools and advice so you know exactly what lenders are looking for, so you can be proactive and in control of buying a home.

Which individuals are considered ‘self employed’?

You are self-employed if your business is registered as:

- Sole trader

- Partnership

- Company (Pty Ltd)

- Company as Trustee for a Trust

And you must be a director and shareholder of your business to be considered self employed.

Contractors are considered self-employed if you pay your own Superannuation and PAYG obligations.

Chapter 2

How long do I need to be self employed for to get a home loan?

If you have been operating for less than two full financial years, then yes, you can still get a home loan approved.

But there are some trade offs you will need to make which for many people are not a big deal if it means getting into your home sooner.

1. Less than two full financial years.

It does mean you need to make trade-offs with your home loan, such as:

- Restrictions on which lenders you can use

- May have higher interest rates

- May have to put in a higher deposit.

These trade offs may not be an issue for you anyway, when it means buying a home sooner.

Key points:

- Aim for for at least one full financial year operating, under your belt, before you apply for a home loan. This gives lenders one year of tax returns, financials and your Notice of Assessment, to base your home loan off

- If you have been operating for less than one full financial year, options are limited but it is still possible.

Exemptions if you worked in the same industry previously.

If you are employed and then switch to running your own business in the same industry, it can mean banks will consider giving you a home loan even if you have only been business for less than one year.

2. More than two full financial years.

Banks want to see consistent year on year turnover as it shows reliability of income which is important when you are looking at a 30 year home loan.

This consistent income opens up your options as to which banks and lenders you can apply too for a home loan.

If for example, your business had a profit of $100,000 for two financial years in a row with no business debts, then the bank would consider your borrowing capacity to be the same as an employee (with regular payslips) who was earning $100,000 a year.

The reality is almost no business owners have this consistency or simplicity with their finances, which is where things start to get more complicated when getting a home loan.

Blank

3. Case Study [Less than two years but in same industry].

John has been electrician for 9 years working as an employee for a large company.

Fourteen months ago he went out on his own and has been profitable with a steady stream of clients booked ahead.

Many of his clients are from his previous company and his old supervisor often sends him additional work when they are over capacity.

John has earned about 18% more working for himself than he did as an employee.

He would now like to do major renovations and add a pool to his family home as he needs more room for the kids.

John also feels confident that his income will continue.

As John has worked in the same industry before, some banks may approve his home loan and waiver the two year requirement.

If John instead, had previously been a clothing sales assistant, he would not be able to get a home loan straight away and may need to wait the two full financial years.

The key point is, banks are more lenient if your new business is in the same industry.

4. I am applying with my partner who is an employee (I am self employed) - how does it work?

The self-employed applicant goes under the guidelines in this post and the employed person is assessed under different guidelines.

When determining what you can borrow, generally banks will add your serviceable incomes together which means you will probably have a higher borrowing capacity.

5. Importance of GST and ABN registration

Banks will check when you registered your business for an ABN (Australian Business Number).

A major bank, wants to see you have been in business for two full financial years.

Using your ABN registration date is the best way for them to verify this.

GST

Banks will also look to see if you are GST registered (Goods and Services Tax).

In Australia, you need to be registered to pay GST if you turnover $75,000 or more a year through your business.

You also need to do your BAS (Business Activity Statement) every quarter which Banks will also want to see.

So if you are not GST registered, then you can not claim to be earning over $75,000 on your home loan application.

Chapter 3

Do this Quiz [Can you get a home loan]?

After speaking to many business owners, it became obvious that the tougher criteria on the self employed to get loans means it is harder to know if owning property or refinancing is even an option to consider.

This Quiz removes much of the confusion.

Check back here early in 2021 when the Quiz has been released.

If you need to get answer now, just click the ‘Book a Free Assessment’ button and I can tell you over the phone.

1. Do the Quiz [Available early 2021].

After answering some questions on your finances, the Quiz tells you if you fit within the bank ‘criteria’ for getting a home loan approved.

Specifically:

- Can I get a home loan approved

- Will I get my loan with a major bank, smaller bank or non bank lender

- Do I have any ‘red flags’ that may impact being approved.

Red flags will delay how long it takes to get your loan approved, or worse, get your loan application declined.

Use this Quiz as a tool to get yourself prepared early on, even up to two years before you go to buy a property.

It means you can work towards resolving any problems now, so you can make an offer on a property sooner.

Chapter 4

Banks V Non Bank lenders V ‘Low Doc’ loans, which is best?

Should you get a loan with the lender your business banks with now, or are there better options?

In this chapter I break down the difference between groups of bank and lenders.

You will learn why at the end of the day, most self employed people have just a small handful of lenders to choose from for their home loan.

1. Why so many banks and lenders?

If you already have a good relationship with them, your chance of getting a home loan with them should be higher… right?

So when your bank comes back and says ……’no’ …… many people translate that too… ‘no other bank will give me a home loan either’.

The dream of buying your next home or investment property ends there.

This is not true.

You see, getting a home loan approved these days has more to do with business profits over the last few years and how the bank interprets them, rather than how long you have been a customer.

Different lenders are like different clothing brands.

Many people view banks are all the same.

When in fact, they target different ‘types of client / people’.

In the same way that Quicksilver targets surfers, Rodd & Gunn targets country and King Gee targets tradies, lenders target different people too.

For example, a lender can target self employed people, tradesmen, medical professionals or first home buyers (to name but a few).

What this means is when Bank A declines your home loan, Bank B and Bank C may approve your home loan.

Because of this targeting, as a self employed person, there may be only a handful of lenders who will approve your home loan.

The point is, as a Mortgage Broker I keep track of the niches each lender specialises in (these can change regularly).

This means I can recommend which bank /lenders are most suitable for your specific financial situation.

2. Banks versus non bank lenders

If we can’t get you a home loan approved with a bank, then we look at the non bank lenders.

Based on the feedback from other clients, the major and most smaller banks generally give you a better all round experience such as better online banking and a better interest rate.

But the challenge is that banks usually only approve home loans for the self employed who are established business with reliable cash flow and manageable debts.

Fortunately, non-bank lenders specialise in self employed people, as they are more realistic about the ups and downs of running a business.

They know business owners can still reliably make home loan repayments on time every month.

Over 40 banks and lenders offer home loans

Blank

3. Trade offs to use a non bank lender for your home loan.

However banks do have tougher criteria / guidelines you need to meet and are often not willing to be flexible (for example, for being late on a credit card repayment a year ago).

Non bank lenders understand that business’ have ups and downs and that sometimes your financials may not be perfect.

This comes at a small (or sometimes large) price.

Interest rates and fees can be higher at non bank lenders given the extra risk of lending to a business owner who may not have been operating for two full financial years.

For you, this price may be insignificant when it means the satisfaction of buying the home you want now!

Lets go through the differences between these groups of lenders.

Major Banks

Will generally give you the ‘best’ on offer (compared to non bank lenders):

- Lower interest rates & fees (more comparable to those who are employed).

- Better loan features like multiple offset accounts

- Superior online banking platforms

- Better access to customer service, ie branches, 24/7 call centres

- More responsive customer service, especially in an emergency.

Smaller Banks

Offer some of the features of major banks, but not all of them.

They often specialise in helping people who fit a certain niche such as contractors or tradespeople so can be a good option too.

Non bank lenders

Non bank lenders are often the hero for self employed people – they are a great option for a home loan.

Simply, they are more flexible with their criteria and make it easier for a business owner to get a home loan approved quickly.

4. Are 'Low Doc' or 'Alt Doc' loans a good option for the self employed?

If we can’t get you a traditional home loan with a bank or non bank lender, we will look at a ‘Low Doc’ or ‘Alt Doc’ home loan for you.

Banks now call Low Doc loans, Alt Doc loans.

It means you are proving your income in an ‘alternative’ way, other than providing two full financial years of tax returns, financials etc.

The most common reasons (there are more) for using ‘Alt Doc’ lenders for business owners are:

- Have not been in business for the two full financial years or have not done their tax returns (so they can’t go with a bank); and /or

- Inconsistent turnover for the last two full financial years (i.e. last 6 to 12 months are more profitable and feel confident this turnover will continue); and /or

- Credit issues (i.e. late payments on home loan or an ATO debt).

Ways to prove your income

Alt Doc lenders have less stringent requirements for proving business income which is a big reason why they are a good option, for example:

- Most recent 6 or 12 months of BAS statements

- Banks statements from your business showing turnover

- Interim financial statements

- A letter from your accountant verifying your past income (rather than providing tax returns / financials etc).

Which lenders are best for Alt Doc loans

There are only a small handful of lenders who offer Alt Doc loans.

As a Mortgage Broker we look at what documents you can provide to verify your financials, and match this to the lenders whose criteria you meet.

Due to the increased risk to the Alt Doc lender, these loans may:

- Have higher interest rates

- A larger deposit usually required – usually a minimum of 20% (if you have less than 20% your interest rate may be significantly higher)

- Risk fee – may need to be paid if you are borrowing more than 60% of the value of the property (the cost is similar to Lenders Mortgage Insurance).

Down the track when your business has had two full financial years operating, and you have had the time to sort out your tax returns, we would look to refinance you back over to a bank or non bank lender with lower interest rates.

For most people, an Alt Doc loan is a starting place.

Blank

5. Case Study [Last 6 months more profitable than previous].

The last 6 months have been much more profitable than previous years as Frankie has signed some new contracts and she feel confident this level of income will continue.

Here are her profit figures for the past few years:

- Last two financial years, profit of $65,000 (FY18) and $95,000 (FY19);

- Most recent 6 months profit – $140,000 (with full year profit annualised to $280,000).

Getting a home loan with a traditional bank is not a good option as the bank would base Frankie’s home loan off the last two financial years of $65,000 and $95,000 (meaning a low borrowing capacity).

Instead, we would look at applying for an Alt Doc home loan.

The Alt Doc lender would use the last 6 months of profit of $140,000 – which the bank will annualise to $280,000.

Using the Alt Doc lender will mean a much higher borrowing capacity.

I would not recommend Frankie borrowing the maximum based on $280,000, but going with an Alt Doc lender gives her more options than she would have going with a bank.

Frankie would need to provide the business’ last 6 months of BAS statements, and 6 months of business banking statements, to prove the $140,000 income over the last 6 months.

While Frankie may have a higher interest rate, the idea is she will refinance her home loan to a ‘bank’ once she has two full financial years of business tax returns and financials.

Chapter 5

What stops most business owners from getting a mortgage?

Here I give you the five most common challenges faced by business owners when it comes to getting a home loan approved, and importantly what we can do to help.

Five most common reasons self employed people can’t get a mortgage.

Read through to see my recommendations on what to do next.

Blank

1. Current income is significantly better than previous two years.

Often the owner has spent the last few years or more, in start up or investment phase paying themselves a low / modest income.

Now they feel the business has turned that corner for good and they are in a growth phase which they expect to continue.

If this is you, the question is…

“How much can I spend on a new home now?”

The answer depends on which bank we use.

There are some very large variations in borrowing capacity, as most banks calculate serviceable income differently (see chapter 8).

Also consider what you can comfortably afford to repay in home loan repayments now and into the future.

Case Study

Andy wants to buy a home.

He runs ‘Top Plumbing’ which recently invested heavily in social media resulting in a very profitable last 6 months, where they are now on track to make a profit of $210,000 for the full financial year.

The previous two financial years are not as profitable.

Profits

- FY 1 – $80,000 (start up year)

- FY 2 – $160,000

- FY 3- (9 months year to date), $157,500 and on track to earn $210,000 for the full financial year.

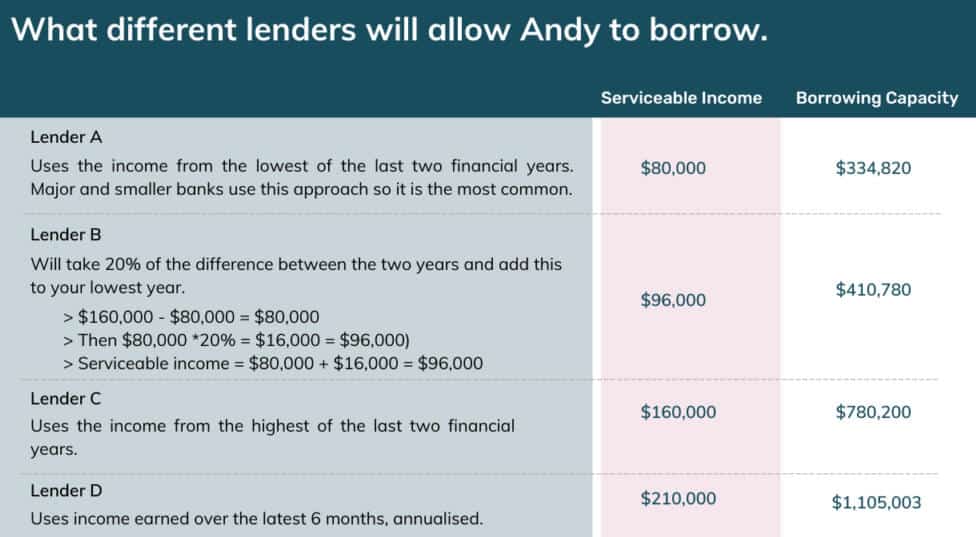

How serviceable income is calculated differently across banks / lenders.

Andy’s serviceable income (which is the income the banks’ determine he earns) ranges from $80,000 to $210,000 across four different lenders.

This means there is a large variation in what Andy can borrow for his loan depending on which lender he chooses for his home loan – from $334,820 with a major bank through to $1,105,003 with a non bank lender.

This will make a huge difference what location Andy’s family can buy into and what he can afford to spend on the home.

At Blackk Finance, work through these serviceable incomes and lending options for you.

Having a clear picture of your finances and what you can afford to repay is crucial but ultimately it is also your responsibility to make sure you can comfortably repay the home loan.

Every one of us wants the best home we can afford and we’ll help you work out that is.

‘* Figures based on assumption of no business debts.

2. Have not been in business for the full two financial years.

Here is an example of two different lenders:

Lender A (Alt Doc Lender)

Will base your serviceable income off the most recent 6 months of trading which is then annualised.

You need to provide see 6 months of BAS statements and 6 months of banks statements to prove your income.

Lender B (Alt Doc Lender or a bank)

Will base your serviceable income off just the most recent one full financial year.

This works best when you have worked in the industry, previously as an employee with payslips. This is common for those who go on to contract or a trades person who sets up his own business.

For example, you have one full year of trading plus another 6 months.

- Part year for FY 19 – business set up in January 2019 and made a profit of $52,000 by end June 2019.

- Full FY20 – profit of $130,000.

The lender would accept the one and half years of trading (rather than the two full financial years of trading).

3. Small deposit saved or no access to equity.

The exact deposit required will vary on both your individual financial situation and also on the banks guidelines..

To be able to put up only a smaller deposit like 7%, your personal financial situation needs to fit a ‘best case scenario’, which you can read more about in Chapter 6.

As you will soon see, if you only have a low deposit saved, you need to make up for it in other ways, for example by:

- Having two full years of tax returns done; and /or

- Showing your business has a consistent and reliable income, where for the second FY, your income is from 0 to 20% higher (to show some growth but is overall fairly consistent).

Please get in touch with me and I can discuss specifics with you.

Case Study

Imagine three different self employed people who all want to purchase a property for $800,000.

The deposit required is different for all three of them as each has a different financial situation.

Person A can put forward the lowest deposit as she has a stronger financial situation.

Chapter 6, coming up next introduces the idea of different guidelines or rules banks’ use to determine how much deposit you need saved.

Different Deposits Required

4. Default or late payment of a home loan / over drawn accounts.

Banks will look at two things to check your credit history:

- Your credit file; and

- Your banks statements over the last few months to see if there are any late or missed repayments.

If there are significant and recent marks against your name, then you will likely need to go with non bank lender for your home loan.

- A significant mark, is for example, being 2 weeks late making a repayment on a personal loan or home loan in the last few months.

- Less of issue (but still concerning to the lenders) is 6 months ago, you were late with one of your credit card repayments by 3 days – in this case it may not be an issue if you can provide a reason.

If you do have more significant marks against your credit file and you want a home loan approved, you need to ‘off set’ this by:

- Putting up a bigger deposit, of say 20%; and

- Have a reasonable explanation for why you have credit issues.

If you have missed repayments, it is better to be upfront and explain what happened and why you missed the payment.

The bank you are applying to for your home loan will find this information out anyway when they run their checks on you, so it is much better to be honest.

This is very much a case by case basis here so if you are wondering where you stand it is best to go ahead and book a free assessment with me and we can talk about this.

5. Directors who have less than a 50% shareholding in a company / company as trustee for a trust.

If you want to use the profits of a business, as a part of your income, be aware that most banks will want you to have at least a 50% shareholding.

If you have less than a 50% shareholding, some banks will not consider any of the retained profits or add backs from the business. They will only look at what is being paid to you personally in your tax returns.

Being ‘declined’ by a bank can also come down to inexperience

Blank

1. Business’ account for their income and expenses differently making it hard to see how much money you really make.

Here are the common areas which make the ‘money waters’ a little murky:

- Cash out – Some businesses take cash out of the business so it is technically not on the ‘books’ and will mean your tax returns show a lower income that what you are really drawing;

- Moving money through trusts – Many business, especially successful ones, will pay a trust which then distributes money out to reduce tax;

- Expenses – Often business’ will funnel expenses, such as a car lease and phone through the business. Some lenders will want you to account for this personally which reduces your taxable income;

- Paying extra super contributions – Some banks will ignore these extra payments while others will consider it a personal expense which impacts your borrowing capacity.

2. Lack of experience of bank staff who are assessing your home loan means they could decline your loan

The challenge is that some people who work in finance may not be well trained / experienced in interpreting and understanding business financials.

If your finances are fairly straight forward, such as a partnership or sole trader, then it may be easy enough to verify your situation and approve your home loan application.

However, we find that most self employed people applying for a home loan do have more complicated financial structures and money flows.

If bank staff are not comfortable or do not fully understand your financials, then they will come back with questions or decline your loan application.

I learnt to understand business accounting at uni which at the time I found really boring, but it became a lot more interesting in real life when I could apply it to running my own business’.

At Blackk Finance, we provide lenders with very extensive notes and descriptions on your behalf as to how your business earns income and how it moves through your business.

We aim to explain your case clearly so bank staff are very comfortable with your finances and then approve your loan quickly.

This is why we ask you so many questions early on so we can understand your situation as it massively improves your chances of getting your home loan approved.

Chapter 6

Guidelines to get home loan approved + know the red flags.

We all know it is harder for a business owner to get a home loan, but exactly where and how is it harder?

What are the standard ‘red flags’ a lender will decline your home loan application on?

This Chapter gives you guidelines or criteria used by lenders, when deciding to approve your home loan and outlines some ‘red flags’ to be aware of.

1. ‘Six Categories’ lenders assess you on for a Home Loan as a self employed person.

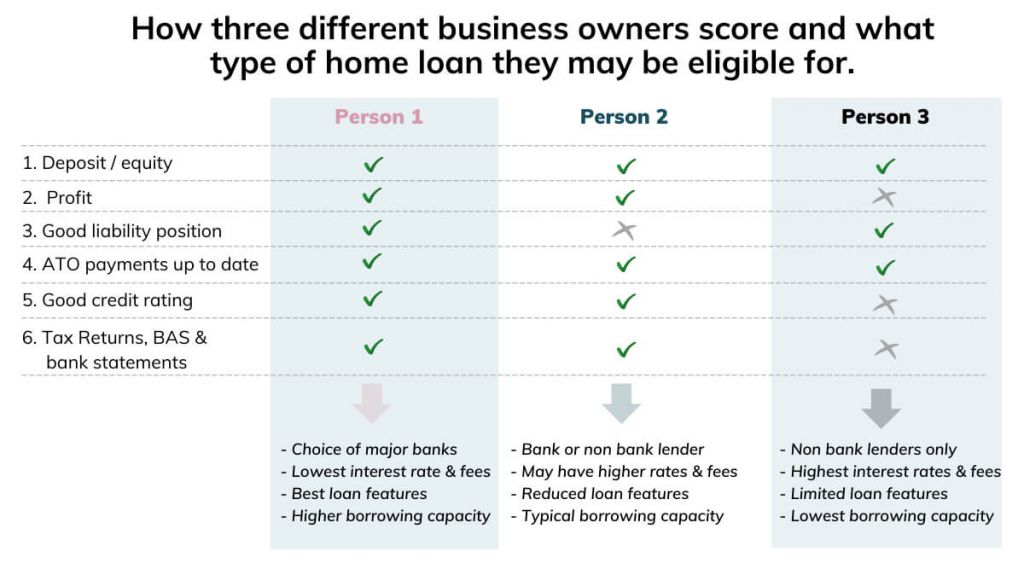

So we came up with these ‘Six Categories’ (table below).

This is a simplified look at the main factors a bank looks into when determining if they will approve your home loan as a self employed person.

I hope it is an easy way for you to see for yourself, which Categories you tick, and where you may have issues (called ‘red flags’).

If for example, you have a low deposit saved (Category 1), then we know this will be a ‘red flag’ for some lenders, while other Lenders will still approve your home loan.

It is important to re iterate that while one bank may give you a ‘red flag’, another bank may be perfectly happy to approve your home loan.

It is very much case by case and it is best at this point to give me a call to talk about it.

Six Categories you are assessed on for Home Loan.

2. How you need to rate in each Category?

Cast your eye over the ‘Goal’ column, to get an initial idea of what you need to aim for.

I cover off most of these in detail in the following Chapters, so this is just a snapshot to begin within.

Red Flags that might mean your home loan is declined

If you don’t meet the Goal, then it may be considered a red flag by a lender.

Six Categories you are assessed on for Home Loan.

3. How many Categories do I need to tick to get a home loan?

In the meantime, have a look at this picture and see which ‘Person’ or business owner you think you fit best with..?

For example, Person 2:

- Similar to person 1, they have a good deposit and profit, however they already have a bit of debt, like a personal and/or business loans and credit cards;

- This may mean they can still get a home loan approved, which could be with a bank or non bank lender.

As you can see, all three business owners can probably get home loans approved with different lenders, however Person 2 and 3 will not have as many banks/ lenders to choose from and may need to pay higher interest rates and /or have a higher deposit saved.

These six Categories give you some idea as to where you stand, but in reality every self employed person is different – it is really case by case.

Chapter 7

How much deposit (or equity) do I need?

The exact amount of that deposit will vary depending on how well you rate across the Six Categories I talked about in the previous chapter.

Generally, the less ‘risky’ the bank thinks you are, the less deposit you will need saved.

Let’s go through this in more detail.

1. How much deposit do I need saved to buy a home?

It is always best to save 20% (plus buying costs) as this means you avoid paying Lenders Mortgage Insurance (LMI), which can be a significant additional cost. LMI can be added to your home loan so you usually do not need to pay for this upfront.

There are two parts to this deposit (7% to 34%):

- Deposit to secure the property – ranges from 5% to 30% of the purchase price of the property.

- Plus buying costs – add an additional 2% to 4% of the purchase price.

Buying costs include:

- Government stamp duty, transfer fee and mortgage registration fees; and

- Costs that you pay as the buyer, including the solicitor/conveyancing fees and building and pest inspections.

You can use equity from another property to cover the deposit but check with me first as there are some considerations that may affect being able to access it, such as cross collateralisation.

Let’s look at an example:

If you purchase a home to live in for $1,000,000 then you would need at least $63,000 in savings as the deposit on the property, plus an additional $38,000 in savings to cover buying costs. In total you would need $101,000 in savings.

- Purchase price of the property: $1,000,000

- Minimum deposit required: $63,000 (6.3%)

- Plus buying costs: $38,000 (3.8%)

- Total minimum deposit required: $101,000 (10.1%)

2. Why is there such a big range (7% to 34%) in how much deposit you need saved?

- Amount you are borrowing

- Your income

- How well you rated with the Six Categories (covered in Chapter 6)

If you meet a banks requirement across all Six Categories, you are considered lower risk and hence can put up a smaller deposit (closer to 7%).

As soon as you start missing some of the Six Categories, you are seen as a higher risk to the bank.

To ‘offset’ or ‘overcome’ this risk, banks will ask you to put in a bigger deposit.

Banks operate with the idea that the bigger your deposit, the less at risk they are.

To qualify for less than a 20% deposit, you will need to pay LMI and show:

- Consistently good income

- Good credit rating

- Good liability position

- No ATO debts

- Plus the benefit of getting a home loan with a major bank.

3. Can I get any First Home Owner Grants if I am buying in QLD?

Some of these, like the First Home Buyers Grant of $15,000 can be used to boost your deposit.

QLD First Home Buyer Government Incentives

Chapter 8

How much can I borrow as a self employed person?

Now having said this, the estimate of what you can borrow can vary considerably across banks, partly because of what they term your ‘serviceable income’.

I will take you through this now.

1. Income requirements at a glance.

For example, if your personal income is $100,000, you could borrow between $450,000 to $600,000.

Ideally your business has been operating for two financial years showing consistent income.

To prove your income:

- Most major lenders require – 2 years personal and business tax returns / financials

- Smaller lenders and non- banks lenders – 2 years personal and business tax returns / financials

- Low Doc lender – Combination of accountants letter, bank statements, BAS statements.

2. What you can borrow at a glance.

3. What is ‘serviceable income’ and how does it determine what I can borrow?

Your serviceable income determines how much you can afford to borrow and spend on a property.

This is the income the bank determines you earn according to their own criteria.

It is not the same as your taxable income.

It is really important to understand that every bank will come up with a different serviceable income figure after pouring through your financials.

Here are some things that effect your serviceable income:

- Addbacks – are one off expenses your business has paid for, such as a the purchase of equipment, which is added back onto your income (and increases your borrowing capacity). Covered in more detail in Chapter 9.

- Debts – some banks will include the business debts (credit cards, overdraft, leases) which reduces your serviceable income (and your borrowing capacity).

Turnover V Profit V Taxable Income

Some very simplified accounting definitions for you:

- Turnover – is your sales

- Profit – is your sales less expenses

- Taxable income – your regular salary plus business profits less deductions (in your personal tax return)

Income from Family Tax Benefit (FTB)

FTB income usually does count towards your serviceable income. Make sure the amount your claim you earn on your home loan application matches what Centrelink will have on their records.

As a Mortgage Broker, we look calculate your serviceable income across a number of lenders so you can see how your borrowing capacity changes.

4. Do I need home loan pre approval?

Every client we help gets what I call an ‘Informal Pre approval’ which is where I make enquiries to a range of lenders of your behalf (without providing your details) to make sure that bank will approve your loan application.

If after the ‘Informal Pre Approval’ we still are not certain that your loan will be approved, we then proceed to asking one chosen lender for a ‘Formal Pre Approval’.

Situations when we could ask for a ‘Formal Pre Approval’:

- When borrowing a large amount (over $1,000,000)’

- If you are buying withing the next 60 days;

- There is only one lender as an option

- Buying land and building a home

- Issue with your credit score.

The guidelines for when to get a pre approval are the same for if you are an employee with regular payslips.

Chapter 9

How do debts and ‘addbacks’ impact you getting a home loan?

These are known as add backs and some examples are depreciation, additional superannuation paid and one off costs like moving your office.

Credit cards and personal loans, however, will reduce what you can borrow.

Let’s go through this in more detail.

1. How do add backs increase your serviceable income and borrowing capacity?

These expenses reduce your taxable income.

However your taxable income isn’t the income that banks use to assess how much you can borrow when you are self employed.

Instead banks will calculate a serviceable income for you, where they increase your income by adding back some business expenses.

Usually this means you can borrow more.

It may come as no surprise at this point that every bank will have a different policy for which expenses they will ‘add back’ to calculate your serviceable income.

Examples of add backs are:

- Depreciation: Depreciation is an accounting expense, so some lenders add it back to boost your servicing income

- Additional superannuation: If you’ve paid voluntary super contributions over and above the compulsory 9.5% then these can be added back to boost your serviceable income

- One off expenses: If you have paid one off expenses like a bad debt, cost of changing accountants or moving costs then these may be added back

- Interest expenses: where you have paid interest for things like an overdraft account, credit card, car lease or a business loan then these expenses may be added back to increase your serviceable income.

2. What is the maximum amount of add backs a bank will use?

Banks have different rules as to how many add backs they will consider.

The most common approach used by banks is the 20% rule, where they will add back the eligible expenses worth up to 20% of the profit (option B in the table).

Other banks will use alternative approaches to this as shown in the table also.

Example:

Example how three different banks will view add backs

In this example, the business has $30,000 of depreciation and interest from a business credit card and both can be allowed as ‘addbacks.

Business results

Full Financial year profit – $100,000

Potential add back expenses – $34,000*

‘* Includes depreciation for $30,000 + interest from credit card for $4,000

This is how a range of banks will view your addbacks:

How three Banks treat one business' addbacks

3. How personal credit card and personal loans reduce your borrowing capacity.

Credit card limits

As a general rule of thumb, every $1,000 of credit card debit reduces what you can borrow from between $4,000 to $7,000 approximately (depending on the lender).

Here is an example with one lender.

A $10,000 credit card will reduce what you can borrow by $57,000 and with another lender it would reduce what you can borrow by $67,000.

I am not saying that you should close all credit cards as having one shows the banks you can manage debt.

The message is simply to only keep your credit card limits to a minimum where possible.

Personal loans

Personal loan repayments reduce what you can borrow as well.

For example

- Making a $100 repayment each month on your car will reduce your borrowing capacity by $15,000

- Making a $600 repayment each month will reduce it by $90,000.

The tricky part is, if you have savings which you were planning to use as a deposit to buy a home, should you keep it for a deposit or pay down your personal loan?

The answer is it depends. I really need a clear picture of your financial situation and plans.

Chapter 10

How to get prepared to apply for a home loan.

Start looking at preparing your finances from at least 6 months to up to 2 years before buying a property or refinancing.

Prepare by getting your last two years of tax returns and financials done, as well as making sure your BAS statements are up to date.

At this point, it is worthwhile to book a call with me so we can go through your situation in much more detail.

Being proactive to get better idea of where you stand and an action plan from me will save you time, effort and disappointment down the track.

Getting ready

At this point, please book a call with me and I can give you advice that is specific to your situation.

I will give you some more specific actions to take such as:

- How much deposit you need saved

- Being mindful of what you spend your money on – banks look at your transactions history for any spending that may indicate you are not responsible with money

- Getting a copy of credit file

Paperwork required to apply for a self employed home loan.

Company’ or a ‘company as a trustee for a trust’

To prove your income when you have a ‘company’ or a ‘company as a trustee for a trust’ then generally need:

For your business:

- Last two financial years of tax returns

- Last two financial years for your business financials

- Business banks statements for last 35 days and up to 6 months worth

- BAS returns since your last tax returns.

Sole trader

If you are a partnership or sole trader you usually need

- Last two FY years of tax returns

- Last two years Notice of Assessments for you personally

- Last two years business financials

- BAS returns since your last tax returns

- Business banks statements for last 35 days up to 6 months.

Plus for you personally:

- Last two financial year tax returns and Notices of Assessments

- Banks statements for last 35 days.

Examples other documents required:

- Copy of drivers licence or passport plus medicare card

- House contract

- Receipts of any deposits paid on the house

Further reading

My name is Victor Kalinowski and I’m a Mortgage Broker at Blackk Mortgage Brokers, with offices based in West End (Brisbane) and Burleigh Heads (Gold Coast).

If you would like to talk about your personal situation in more detail, please go ahead and book a free 15 minute call with me here if there is any way I can help you further.

The information contained within this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2023.