First Home Owners

Grant QLD

2024 Complete Guide

Start The Quiz

Let’s get right down to the heart of the matter.

You want to get into your first home, and you are hoping to get money from the Queensland government to help you buy sooner. Or buy better.

The challenging part is working out which government programs you may be eligble for.

The easiest way to find out what Government help you may be eligibe for is to simply complete the 1 minute Quiz below.

The remainder of this Guide covers the $30,000 First Home Owners Grant which is for those of you who are building a home.

Cheers,

Victor Kalinowski.

First Home Owners Grant Qld Complete Guide [2024]

Chapter 1

What is the QLD First Home Owners Grant?

1. What is the Queensland First Home Owners Grant?

The QLD First Home Owners Grant (formerly known as the The First Home Buyers Grant) is now a $30,000 one off cash payment from the Queensland Government, towards the cost of a new home.

It is for people who are building their first home or buying a brand new home that has never been lived in before, in the state of Queensland.

It can be used for houses, units, apartments or townhouses.

2. Is the First Home Owners Grant in QLD still available?

Yes. It certainly is.

The Grant is a national scheme that is funded by each state or territory.

The Queensland State Government has said the $30,000 First Home Owners Grant will run from 20 November 2023 through to 30 June 2025.

When they increased the Grant in November 2023, there were no other changes to the eligibility criteria.

We monitor the QLD Budget announcements and will update this page as changes to the Grant are announced – check this page or follow our socials where we will post any updates on this.

Chapter 2

How much deposit do I need when building with the QLD First Home Owners Grant?

1. Can I use the $30,000 First Home Owners Grant as my deposit?

The good news is, yes you can use the Queensland $30,000 First Home Owners Grant as part of your deposit to build a home.

The $30,000 Grant will help you reach your savings goal sooner.

The exact deposit you need saved depends on a few different criteria and I go through this in more detail below.

If you are seriously looking to make some decisions, then please book a free 20 minute call with me and I can tell you exactly what you need to save.

2. How your building budget determines which first home owner grants & schemes you could be eligible for.

At this point you are probably aware that there are five First Home Buyer programs in QLD (covered in chapter 6).

We find that most of our clients who are building end up getting three first home buyer programs.

These are the:

- QLD First Home Owners Grant for $30,000 – covered in this guide; &

- First Home Buyer Guarantee– where you buy with as little as a 5% deposit and pay no Lenders Mortgage Insurance; &

- QLD First Home Concession – gives you a concession on the stamp duty you pa when you spend under $400,000.

There are of course a number of eligibility criteria involved (chapter 4), however one of the main considerations is the cost of your build.

If you are buying in Brisbane, the Gold Coast or the Sunshine Coast & you spend:

- Under $700,000 in total on land + build (where you spend under $400,000 on land) – you may be eligible for all three programs.

- Between $700,000 and under $750,000(where you spend under $400,000 on land) – then you may be eligible for two programs.

Let’s go through some examples.

3. How much deposit you need saved when spending between $700,000 to $750,000.

This one is for you if you are buying in Brisbane, the Gold Coast or the Sunshine Coast and you are spending between $700,000 to under $750,000 on your land and build in total (or brand new property).

If you do spend within this bracket, then you may be eligible for these two programs:

- $30,000 QLD First Home Owners Grant; &

- QLD First Home Concession.

Let’s go through an example of how much deposit you would need if you spent $740,000 on your house and land in total.

In this situation we will assume:

- Land is $340,000 +

- Cost to Build is $400,000

You can see this in the table below and I’ll go through it line by line.

Deposit Required when Building under the $30,000 First Home Owners Grant

Deposit you need to save ($37,000)

The key point here is that if you are spending $740,000 on your land and build under the $30,000 First Home Owners Grant, then you personally need to save (or be gifted) 5% of the total amount you are spending which is $37,000.

This is a bank requirement, which they call genuine savings as they want to see that you are showing the right money behaviours.

It’s helpful to know that the following count towards this required deposit. If you’ve paid any money to:

- a builder to get a contract/ plans ready; and or

- the seller of the land as a deposit.

Your total deposit ($67,000)

This is the $37,000 you have saved plus the $30,000 from the Grant.

Buying costs ($12,000)

These come in at $12,000.

In this example, as you are spending under $400,000 on the land, you can be eligible for the QLD First Home Concession. This means you only pay $7,425 in Stamp Duty which is included here under Buying costs (if you were not eligible for this Concession the total stamp duty payable would be $10,325 so you are saving $2,900).

Buying costs typically include:

- Government stamp duty, transfer fee and mortgage registration fees; and

- Costs that you pay as the buyer, including the solicitor/conveyancing fees and building and pest inspections.

Minimum deposit ($44,400)

In the banking world the absolute maximum you can borrow is 94% of the total cost of your land and build.

This means you need a deposit of 6%, which is $44,400.

We are using the $37,000 you have saved plus $7,400 of the $30,000 Grant to make up the $44,400.

Total deposit required ($56,400)

This is the total deposit you will need to apply for the loan.

It’s made up of the buying costs for $12,000 plus the minimum deposit of $44,400 to make $56,400.

Cash buffer left over ($8,600)

As you have $67,000 in total deposit saved, and you have spent $56,400 as your deposit, you now have $8,600 left over.

You can use this $8,600 however you like.

This is a great additional bonus as a result of the First Home Owners Grant!

We see our clients using it to:

- Add to your deposit so your home loan is less; or

- Cover expenses through the build like rent or some loan repayments as they start to come through;

- Cover variations to the build such as an upgrade to a stone bench.

Some further considerations for you.

If you choose to borrow 94% (as shown in this example), you will have a much higher interest rate because:

- (i) only a small handful of banks will allow a 94% loan meaning there is a lack of compition so lenders can get away with higher rates; and

- (ii) as you have a low deposit you are seen as higher risk to the bank hence the interest rate is higher. To give you an idea, in early to mid 2024, the interest rate is 2.5% higher than it would be if you were borrowing 80% of the cost of you home (i.e. you had a 20% deposit).

These are all estimates.

It is best to Book a Free Call so I can calculate exactly how much you need saved for your situation.

4. How much deposit you need saved when spending under $700,000.

This second example is for those of you who are spending under $700,000 on your land and build in Brisbane, on the Gold Coast or the Sunshine Coast of QLD.

If you do spend under $700,000 then you may be eligible for three different first home buyer programs.

These are the:

- QLD $30,000 First Home Buyers Grant; &

- First Home Guarantee Scheme (which is where the Federal Government helps you buy with as little as a 5% deposit with no Lenders Mortgage Insurance to be paid by you).

- QLD First Home Concession.

There are several other conditions and eligiblity criteria which include (see the full criteria in chapter 4):

- Must be a permanent resident or citizen; and

- Earning under $125,000 p.a. if single / $200,000 p.a. as a couple; and

- Your land and build need to be completed at the same time when you apply for the Scheme; and

- There needs to be a ”spot” available for you at an appropriate participating lender.

We can help with all this.

We’ve got two examples in the table below, where the land and build are different amounts all totalling to $700,000 for the build and land.

I’ll go through one of these line by line, where:

- Land was $325,000

- Build was $375,000

Deposit Required when Building under $30,000 First Home Owners Grant + First Home Guarantee Scheme

Deposit you need to save ($35,000)

The key point here is that if you are spending $700,000 on your land and build under both the $30,000 First Home Owners Grant and the First Home Buyer Scheme, then you will need to save (or be gifted) 5% of the total yourself which is $35,000.

This is known as genuine savings because the bank wants to see that you are capable of putting money away.

It’s helpful to know that the following count towards this required deposit. If you’ve paid any money to:

- a builder to get a contract/ plans ready; and or

- the seller of the land as a deposit.

Your total deposit ($65,000)

This includes the $35,000 you have saved plus the $30,000 from the Grant.

Buying costs ($10,400)

These are $10,400 of which the main cost is stamp duty.

As you are spending less than $400,000 on land, you can be eligible for the QLD First Home Concession which gives a concession (or discount) on the stamp duty payable, In this example, you are only paying $5,950 in stamp duty where as if you were not getting this concession you would pay the full amount of $9,800 (a saving of $3,850).

Buying costs typically include:

- Government stamp duty (if relevant), transfer fee and mortgage registration fees; and

- Costs that you pay as the buyer, including the solicitor/conveyancing fees and building and pest inspections.

Minimum deposit ($35,000)

One of the benefits of the First Home Guarantee Scheme is you can buy with a 5% deposit (and not have to pay Lenders Mortgage Insurance).

This means you need a deposit of $35,000.

We are using the $37,000 you have saved plus $7,400 of the $30,000 Grant to make up the $44,400.

Total deposit required ($45,400)

This is the total deposit you will need to apply for the loan.

It’s made up of the buying costs for $10,400 plus the minimum deposit of $35,000 to make $45,400.

Cash buffer left over ($19,600)

As you have $65,000 in total deposit saved, and you have spent $45,400, you now have $19,600 left over.

This is such a great benefit of getting the $30,000 First Home Owners Grant.

You can use this money however you like.

We see our clients using it to:

- Add to your deposit so your home loan is less; or

- Cover expenses through the build like rent or some loan repayments as they start to come through; or

- Cover variations to the build such as an upgrade to a stone bench.

Some further considerations for you based on this example when buying under the First Home Guarantee Scheme.

- Lower interest rare – even though you are borrowing 95% of the total cost of the land and build, as you are buying under the First Home Guarantee, you get a lower interest rate as the bank treats you like you have a 20% deposit. To give you an idea, in the first half of 2024 the rate you get is about 2.5% less than the interest rate you would get if you were not buying under the Scheme.

- No Lenders Mortgage Insurance – as you are buying under the scheme, you do not need to pay LMI, which on a $700,000 purchase with less than a 20% deposit, would mean you would need to add an extra $28,000 to $32,000 onto your loan. This is a substantial additional cost of buying a home that you are saving on.

These are estimates.

It is best to Book a Free Call so l can calculate exactly how much you need saved for your situation.

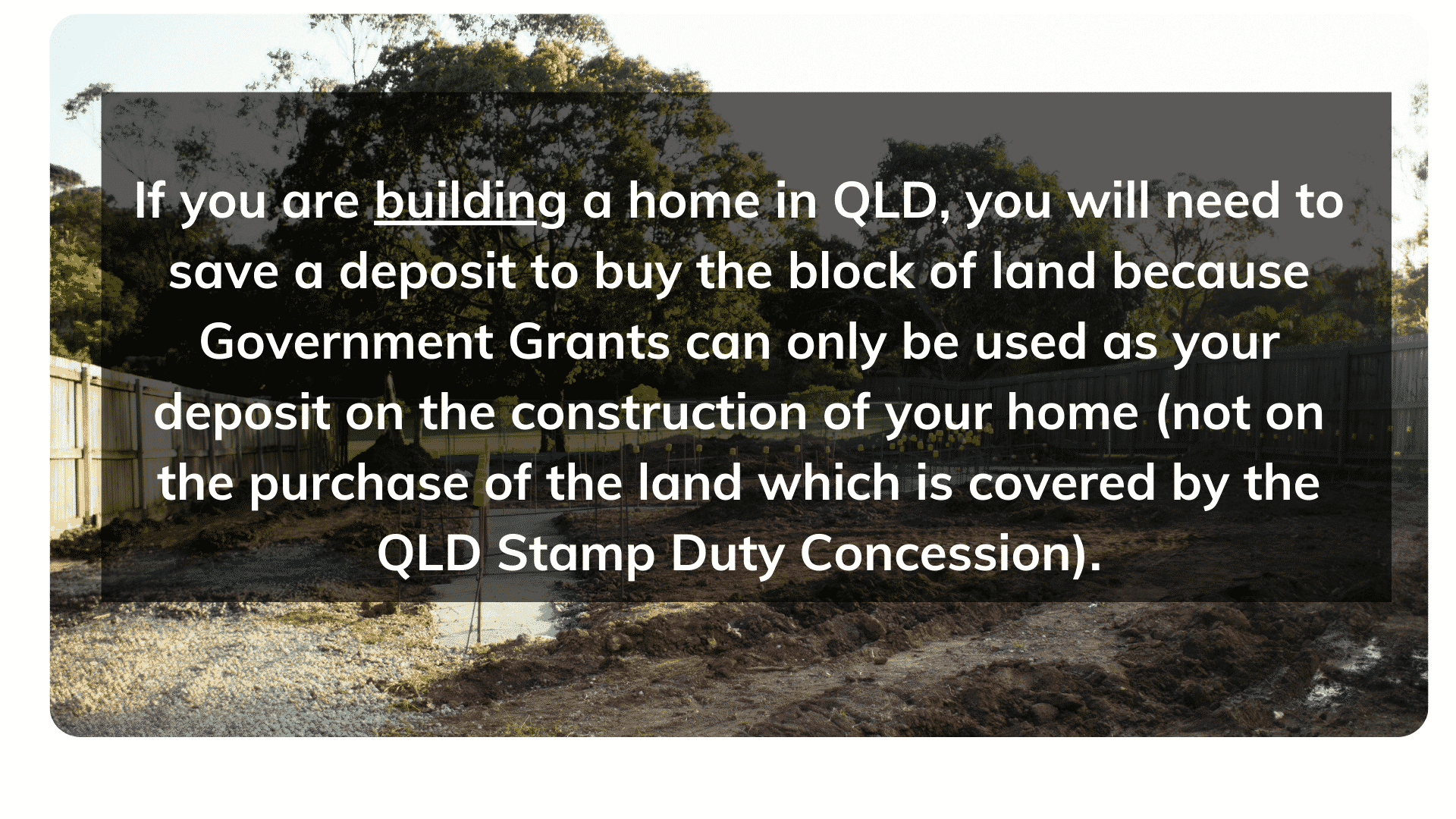

5. The $30,000 First Home Owners Grant can only be used for the build (not the land).

The $30,000 First Home Owners Grant can only be used as a part of the deposit for the cost of the build / to pay the building contract.

It’s taken into consideration when you are doing the loan for the build.

For example if you are buying land today, but planning on signing a build contract in a years time, the $30,000 Grant is only paid when you do the home loan for the building contact down the track.

6. Using the Grant as a Deposit when buying a brand new home.

Using the Grant as a deposit when buying a brand new home is simpler.

If for example, you purchase the home for $700,000 in Brisbane, the Gold Coast or the Sunshine Coast, I have shown the calculations in the table below.

Deposit Required when buying a brand new home under the $30,000 First Home Owners Grant

Deposit you need to save ($35,000)

The key point is that if you are buying a brand new home (off the plan or never been lived in) then you will need to save $35,000 yourself which is a 5% deposit at this stage.

It’s a bank requirement that you save money (or are gifted money) yourself as they want to see that you have the right money behaviours.

Your total deposit ($65,000)

This is the $35,000 you have saved plus the $30,000 First Home Owners Grant.

Buying costs ($23,600)

These typically include:

- Government stamp duty, transfer fee and mortgage registration fees; and

- Costs that you pay as the buyer, including the solicitor/conveyancing fees.

Total deposit required ($58,600)

This is the total you will need to apply for the loan.

It’s made up of buying costs for $23,600 plus the minimum deposit of $35,000.

Cash buffer left over ($6,400)

As you had $65,000 available in deposits and spent $58,600 as the deposit, you have $6,400 left over.

You can use this $6,400 however you like. It’s a fantastic benefit of the $30,000 First Home Owners Grant.

I can calculate these figures exactly for you if you book a Free Assessment, which is just a short 20 minute call.

7. Caveats around using the Grant as a part of your deposit.

The key point I want to make here is that if you want to borrow money from the bank to buy your home, you need to show the bank that you are capable of saving money too.

Getting the First Home Owners Grant and using it as a deposit is a fantastic leg up, but by no means does it give the bank (who is about to take a risk on you), any evidence to suggest you have discipline with your money.

You need to make sure the deposit you save yourself is sitting in your bank account for at least 1 month.

In this time, please:

- Don’t make any withdrawals (even if $1) from your deposit; and

- Continue to add savings to it, as much as possible.

Money Gifts

If you are lucky enough to be gifted money from family that is to be counted as your deposit, make sure this money is sitting in your account for at least one month.

Does rent count?

Banks know, that as a first home buyer, you may not have huge savings, but you probably have been regularly paying rent or a car loan, so they will consider this to be evidence of being able to make regular repayments.

The ultimate person a bank is looking for is one who is saving a few hundred dollars a week – their account balance is going up – and they are making more than the minimum repayment on their debts (like credit card/s).

This regular savings / debt repayment is known as ‘genuine savings’ in the banking industry and it is exactly that – money that has been regularly put aside.

Banks will look at your bank statements to see if you are actually doing this.

Given that the Grant is a one off payment, it is not considered genuine savings on your behalf.

This means (in addition to the Grant) you need to save money and / or show you are making regular repayments.

Some examples of the types of ‘behaviour’ banks like to see:

- Making rental payments for your place of living (at least 6 months worth);

- Making extra repayments to get rid of your debt – for example, on your credit card, if your minimum repayment is $500 a month but you decide to pay off $2,000 a month, then this extra $1,500 shows a behaviour of genuine savings. It is considered by the bank to be the same having saved $1,500 a month instead.

It’s important to know that making the minimum repayment on your debts, like credit cards or personal loans each month is not considered enough – you need to be making accelerated repayments to get rid of the debt.

8. Do I need Home Loan Pre Approval?

In short, no, you do not need to do a home loan pre approval before you buy a block of land.

This is how we approach loan pre approvals at Blackk Mortgage Brokers when building a home:

You make an offer on the block of land so we apply for the loan on the block of land;

- At the same time we apply for a ‘Fully Assessed Home Loan Pre Approval’ to ensure we can get the loan for the ‘construction of your home’ as well.

- Once you sign a building contract, we can apply for the loan to pay for the build.

This approach gives you some re assurance (albeit not 100% certainty) that you can afford to build the home!

We want to avoid the situation where you buy the land but the bank won’t lend you money for the build.

If you are buying a brand new home, then you probably do not need to get a Fully Assessed Home Loan Pre Approval. Instead a good Mortgage Broker will do an ‘Informal Home Loan Pre Approval’ which is where you get the benefits without the downsides.

Please feel free to give me a call if you want to know what you should do about a home loan pre approval.

Chapter 4

When is the First Home Owners Grant QLD paid?

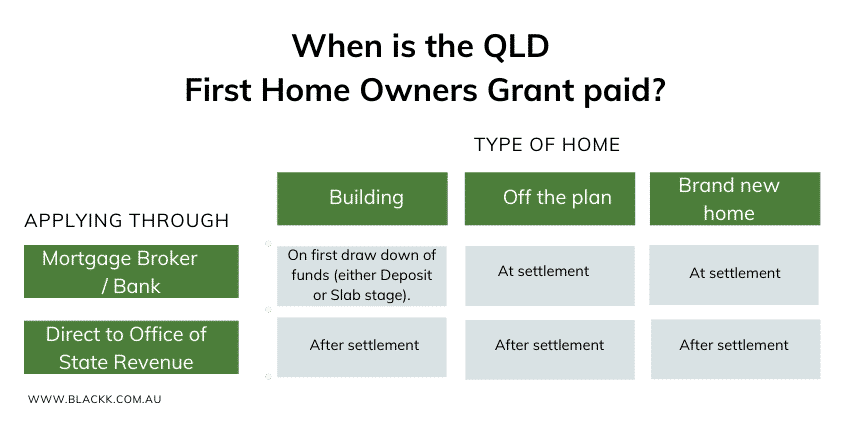

1. When is the QLD First Home Owners Grant paid?

The $30,000 First Home Buyers’ Grant QLD is paid at different times depending on type of property you are building or buying.

The Grant is paid at different times, depending on the type of property (building V buying off the plan), the lender you use and how you apply for it.

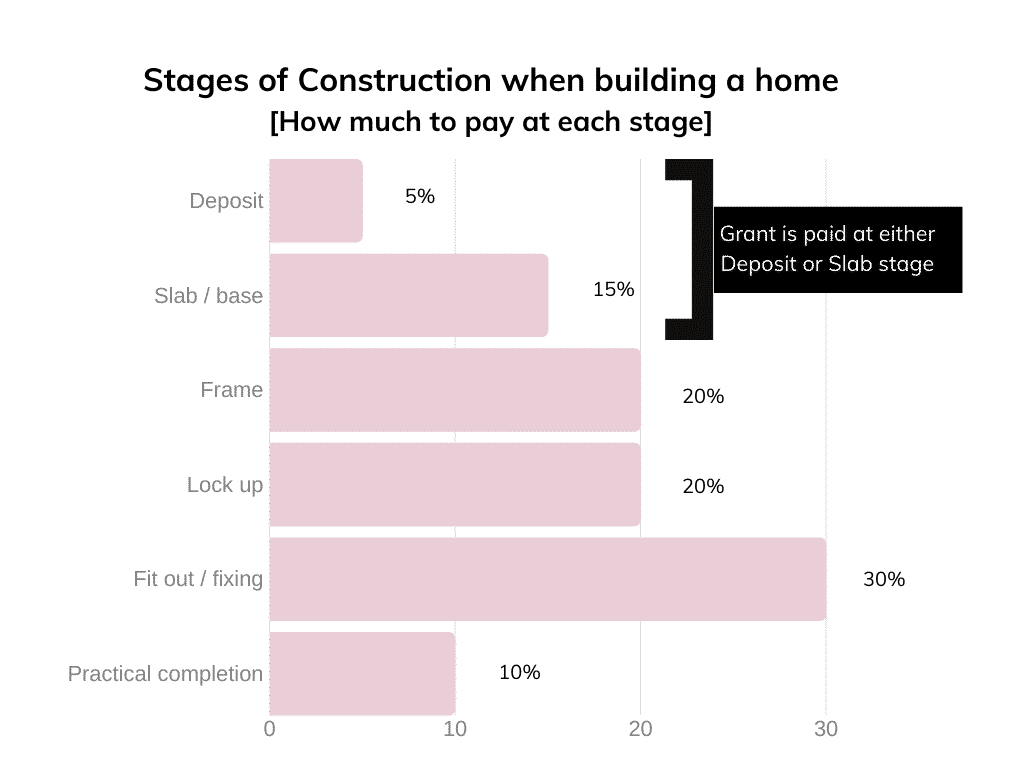

2. Payment of Grant when building a home.

When building a home, the industry breaks the build into milestones or stages where payments need to be made to the builder.

The Grant is either paid at ‘Deposit’ stage or ‘Slab/Base’ stage, depending on which bank you get your home loan with.

Most of the time, the Queensland Office of State Revenue will transfer the Grant amount directly to your lender who will then pay it directly to the builder – in other words the money does not go into your account.

Grant payment at ‘Deposit stage’

If we choose a bank/ lender for your home loan, who pays the Grant at Deposit stage, then the Grant can be used as a part of your deposit to the builder (which is 5% of the cost of the building contract).

The way it works is…

- Your builder would send you an invoice for the amount due at Deposit stage;

- We send the bank the invoice;

- Bank transfers the Grant funds directly to the builder;

- Bank will draw down any remaining amount due from your construction loan or you may have your own savings to cover this.

For example, if your building contract is for $350,000, then the 5% deposit due to the builder is $17,500.

If you were receiving the $30,000 First Home Owners Grant, then the Bank transfers the full Grant to the builder. Then the bank will draw down $3,500 of your funds from your construction loan to pay the full invoice (or you may have $3,500 of your own funds to cover the payment).

Grant paid at ‘Slab stage’

If your lender pays the Grant at Slab stage, then the funds are transferred when your builder pours the slab for your new home.

The process remains the same as Deposit stage.

For example, if your building contract is for $350,000, then the 15% Slab stage invoice is for $37,500.

- If you were receiving the $30,000 First Home Owners Grant, then the Bank transfers the full Grant to the builder.

- Then the bank draws down $22,500 of your funds from your construction loan to pay the full invoice (or you may have some of your own savings to contribute here).

3. Payment of Grant when buying a brand new home which has never been lived in (including off the plan).

If you’re buying “off the plan” or buying a “brand new home” never been lived in before, you will receive your Grant at the settlement of your home (assuming we are applying on your behalf).

This is when you pick up the keys and get access to your new home.

Again, the money is transferred to your lender who will pay the vendor so you won’t get the money directly into your account.

Read More Links

Chapter 4

Am I eligible for the First Home Owners Grant in Queensland?

What are the main criteria to meet to be eligible for the QLD First Home Owners Grant?

The main rules to qualify for the First Home Owners Grant QLD are listed here.

Details are shown in each section below.

Key Eligibility Checks

Blank

Prior Property Ownership

⇒ The key “Prior Property Ownership’ requirement is you or your partner must not have previously owned or part-owned any property in your personal name.

Further details are:

If you are buying your first home with your partner or spouse, they cannot have owned property before either.

The definition of partner is you are married, or living together on a ‘genuine domestic basis’ for 2 years or more.

You can read more on that here with the QLD Office of State Revenue.

So if you are a first home buyer, but your partner is not, whether you get the Grant or not depends on how long you have been together. If you have been together for:

- More than 2 years – you are not eligible

- Less than 2 years – you may be eligible as a single person – you may need to consider title ownership, so best to call me.

If you are not eligible for the First Home Owners Grant, you may be eligible for the Stamp Duty Concession.

Previously owned an investment property

If you have owned an interest in residential property since 1 July 2000 that has been solely used for investment purposes, you may be eligible for the grant on a subsequent property.

You will need to show that you have not lived in the investment property by providing evidence that covers the entire period of ownership:

- Tenancy or lease agreements

- Electricity or phone accounts

- Tax return details declaring the rental property.

Other previous ownership

If you’ve previously owned property in a Corporate Trust, Self-Managed Super Fund (SMSF), or in a Company, this may not be considered to constitute previous property ownership. It is best to call the Queensland Office of State Revenue yourself on 1300 300 734 to determine your eligibility in these circumstances.

Minimum Age

⇒ You must be at least 18 years old on the date of purchase.

Citizenship

⇒ The Citizenship rules to qualify for the Grant are:

- You must be an Australian citizen or permanent resident; or

- If buying your first home with a partner, then you OR your partner must be an Australian citizen or permanent resident.

Also:

- You must not have previously received a First Home Buyer grant in any Australian state or territory.

- If you’re buying with your partner or spouse, they must not have received the Queensland Grant or an equivalent Grant in any other Australian state or territory either.

New Zealand citizens with a special category visa must have a current New Zealand passport to be a permanent resident. You can check if your Visa is permanent or temporary here.

Property Type

⇒ To qualify for the QLD First Home Buyers’ Grant, you must either:

- Build your own home (either as an owner-builder or through a builder you hire); or

- Buy a new home “off the plan”; or

- Buy a new home that has already been built but hasn’t been lived in previously; or

- Buy a “substantially renovated” home (see below).

Can you get the Grant if you are buying a substantially renovated home?

Yes you may be eligible.

Substantial renovations are when all, or most, of the structural or non-structural components of a building are removed or replaced.

Most of the rooms in the building must have been affected, and the renovations must have affected the building as a whole for it to be considered a substantial renovation.

Examples of structural building work are:

- Replacing or altering foundations;

- Replacing or altering floors or supporting walls (interior and exterior);

- Lifting or modifying roofs;

- Altering brickwork to replace existing windows and doors.

The Office of State Revenue does not consider a home to be substantially renovated if only cosmetic work like painting has been done, or a new kitchen has been put in..

Criteria to get the Grant when you are buying a home that has been substantially renovated:

- The home must be:

- Substantially renovated before you buy it (you will not be able to get the Grant if you buy a home, renovate it yourself and then try and claim the grant);

- It must not have been lived in since the renovation.

- The seller of the property must:

- Be registered for GST (or required to be GST registered) and the seller must be selling the property in the course of their business;

- Give you a tax invoice that shows the GST component of the renovation (as evidence that the sale is a taxable supply transaction);

- Provide you with a letter stating that the house has not been occupied or sold since it was fully renovated.

- You must also provide the Queensland Office of State Revenue with a final inspection certificate – a form 11 if your new home is a unit, or a form 21 if your new home is a house.

If you are buying a property that has not be renovated and you want to get the Grant:

- If you’re buying a home that hasn’t been renovated before you buy it, the only way to get the QLD first home buyers grant is if you were to demolish / knockdown the current property and build a completely new house;

- This will only work if you’ve got a substantial deposit – i.e. at least 20% and possibly up to a 40% deposit saved of the amount that you’re wanting to spend overall. The higher deposit is usually needed because of the issues of getting approval from your financier to remove the home already on the property. It’s quite rare and I’ve only heard of it happening a few times.

If you want to place a restored Queenslander on your block of land:

- You may be eligible for the Grant if you buy a relocatable home, like an old Queenslander and move it to a block of land;

Property Purchase Price

⇒ Total purchase price of your property must be less than $750,000.

If you are buying a property “off the plan” or buying a “newly built property”, determining your purchase price is simple:

- It’s the total price that was on your contract.

- To be eligible for the Grant, the purchase price of your property must be less than $750,000.

If you are building your first home:

- To be eligible for the Grant, the total cost of your home must be less than $750,000.

- The total cost of your home can be calculated as:

- Cost of your land +

- Building contract +

- Additional construction costs (features or items such as fences, landscaping, or solar panels).

For example, if you buy a block of land for $350,000, sign a building contract for $400,000 and pay for fencing, landscaping, and a driveway for $15,000, then your total purchase price will be $765,000. This disqualifies you from receiving the Grant.

If instead you applied for a loan for just the price of the land and the building contract (totalling $750,000) then you may still be eligible for the Grant. Check with me first if you do this as there are some caveats around this.

Home Occupancy

⇒ These are the rules for when you must live in the home:

- You must live in your new home for at least six consecutive months; and

- This six months must commence within 12 months of the completed transaction.

If you are building, the date of the completed transaction is the date when you receive the final inspection certificate (right at the end of the build).

If you are buying off the plan this is the date of settlement when the title ownership transfers to you (when you pick up the keys).

If you fail to do this, you will need to pay back part or all of your Grant.

You may also be charged a penalty.

Signed Building or Purchase Contract

To qualify for the First Home Buyers Grant, you will need to have a signed contract:

- If building:

- Purchase a block of land which must be done before you sign a building contract. To learn more about building, read how to build a home step by step guide; and

- Sign a building contract for your new home.

- If you’re buying a brand new home or off the plan:

- Sign a purchase contract for your new home.

Chapter 5

What disqualifies you from getting the QLD First Home Owners Grant?

I recommend you be aware of what might disqualify you from getting the Grants.

In some cases you may be required to show proof and pay back the Grant.

Let’s briefly go through this so you are up to speed.

What could make me ineligible for the $15,000 First Home Buyers Grant?

You may meet the eligibility criteria we have already been through, however there are some circumstances that may stop you from getting the grant.

These are:

- You are a trust or company (i.e. not an individual);

- The new property (home and land) is valued at $750,000 or more;

- You enter into an arrangement to get the Grant, but don’t use it to buy a new home;

- You held an interest in residential property before 1 July 2000, regardless of how the property was used;

- You buy or build your new home with financial help from a related person (who is not eligible for the Grant) who will also stay in the home often, for long periods of time, or for genuine family reasons (money borrowed from a bank or lending institution is not considered to be financial help);

- You or your partner are not aged over 18;

- You move into the home after one year;

- You live in the home for less than 6 consecutive months.

Can you get the grant taken off you?

The Queensland Office of State Revenue regularly audits grant applications to ensure that you have complied with their requirements.

This isn’t surprising – they don’t take the idea of giving you the Grant lightly!

If you have found to have failed to comply with the requirements for receiving the Grant, you’ll most likely need to pay back your Grant along with any additional penalties or fines that the Office imposes upon you.

There are also penalties if you don’t tell the Office of State Revenue within 14 days of finding out that you are disqualified and can not meet the conditions we’ve talked about.

As such, it pays to do the right thing!

Chapter 6

What grants are available for First Home Buyers in Queensland?

What First Home Buyer schemes can I get when building in QLD?

There are currently three main schemes you can access when building your first home in QLD.

You can be eligible for one or all three of these.

The Quiz below is the fastest way to see what you may be eligible for.

What grants can I get when building in QLD?

Brisbane, Gold Coast, Sunshine Coast.

Read More Links:

Chapter 7

How to apply for the First Home Owners Grant Queensland

This Chapter is all about how to complete the Application Form for the First Home Buyer Grant and what supporting paperwork you need to provide.

Skip this Chapter if Blackk Mortgage Brokers is helping with your home loan as we complete the Grant application on your behalf and lodge it with the necessary supporting paperwork.

There is no cost to you to use a Mortgage Broker to do your loan or your Grant application, as we are paid by the bank when your loan settles.

We also advise you along the way on all the important stuff like steps to build a home and when payments to the builder are made.

Do I apply for the First Home Owners Grant myself?

No, I recommend that whoever is helping you with your home loan applies for your Grant – so either the bank or your Mortgage Broker.

This is by far the quickest and most convenient way to have your grant paid.

You can also apply directly through the QLD Office of State Revenue.

How to complete the application form for the First Home Owners Grant QLD.

For our clients, we fill the Grant Application form out at the point where your home loan has been approved and you are signing the loan paperwork from the bank.

We’ll also need you to provide us with some additional paperwork. Some of it we already have from your home loan application and we’ll usually need a bit more.

The application form is fifteen pages long and has seven main sections:

Blank

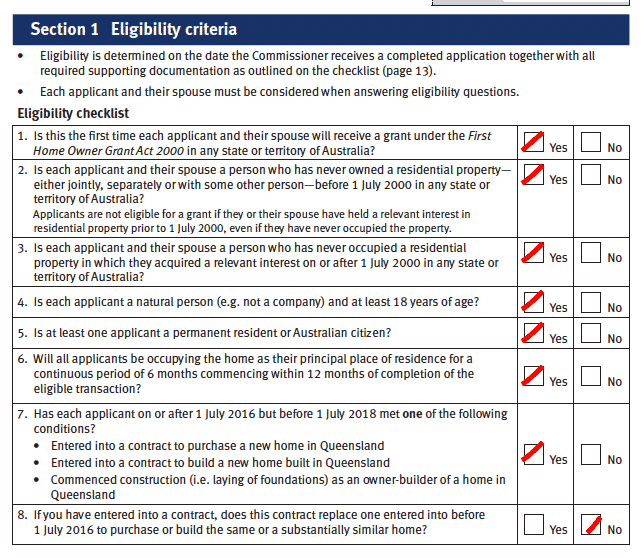

Section 1: Eligibility Criteria

This section involves a simple checklist of Yes / No questions to verify your eligibility to receive the grant.

To be eligible, you must be able to mark “yes” for questions one through to seven and “no” for questions eight through to thirteen.

Section 2: Applicant Details

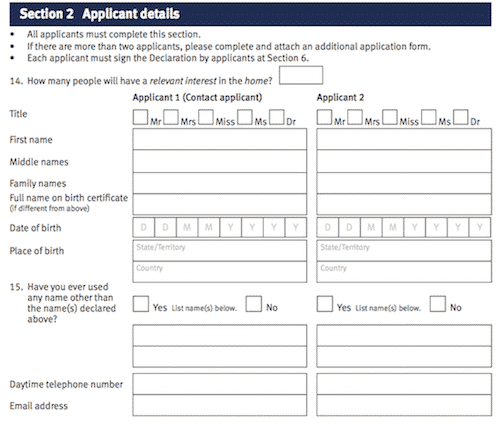

This is your usual name, address, contact details, date of birth stuff that you’ve filled in a million times before, so it shouldn’t be too hard. There is space for two applicants here (e.g. you and your partner / spouse).

If for some reason there are more than 2 applicants (for example, you’re buying a home with your two siblings), you will need to attach an additional application form.

Section 3: Spouse Details

If you have a partner or spouse with whom you are buying your first home and claiming the grant, you’ll need to fill in this additional section (if not, you can skip to section 4).

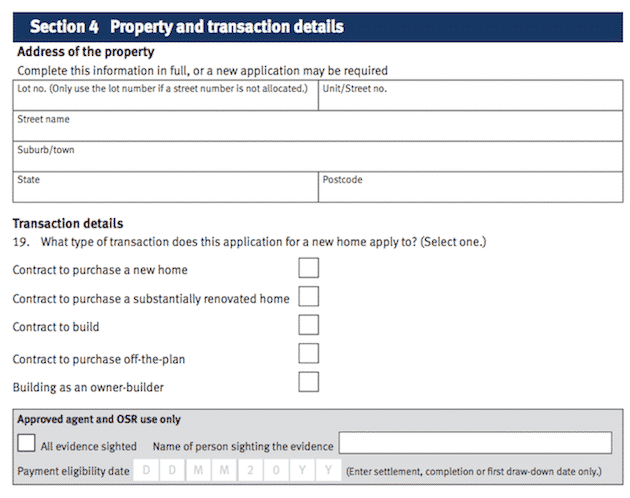

Section 4: Property and Transaction Details

In the fourth section you need to include your property address and indicate whether you’re building a new home, buying “off the plan”, or purchasing a new or substantially renovated home.

Section 5: Optional Information

Only fill in this section if you are of Aboriginal or Torres Strait Islander descent.

Section 6: Declaration by Applicant

This is the part where you sign and provide your bank details so the government has the information they need to pay the grant to your lender.

Your signature must be witnessed by someone who isn’t an applicant. In other words, if you and your partner or spouse are both applicants, they can’t witness your signature. As you’re filling in the application form with us, we can be your signature witness.

Section 7: Declaration by Spouse

If you’re applying with your partner or spouse, this is the bit where they sign. Once again, their signature must be witnessed by someone who isn’t an applicant – like us.

What supporting documents do I need to provide with my application?

The exact requirements will vary somewhat depending on your situation, but you will always need to provide ID documents plus the paperwork for your land and building contracts or purchase contract.

The additional documents we require can be your birth certificate, marriage certificate, passport and proof of citizenship.

Blank

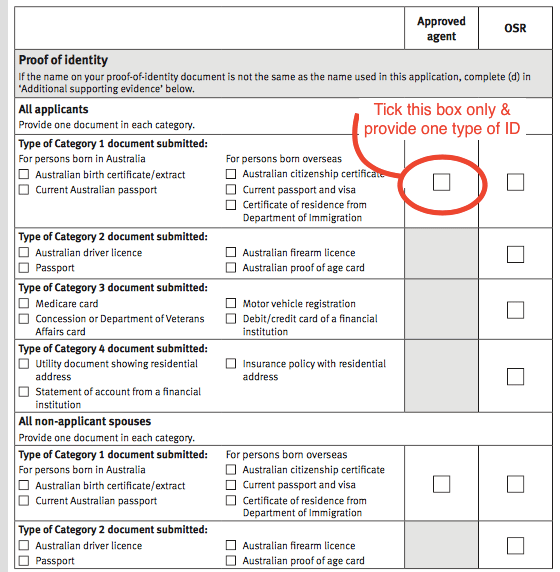

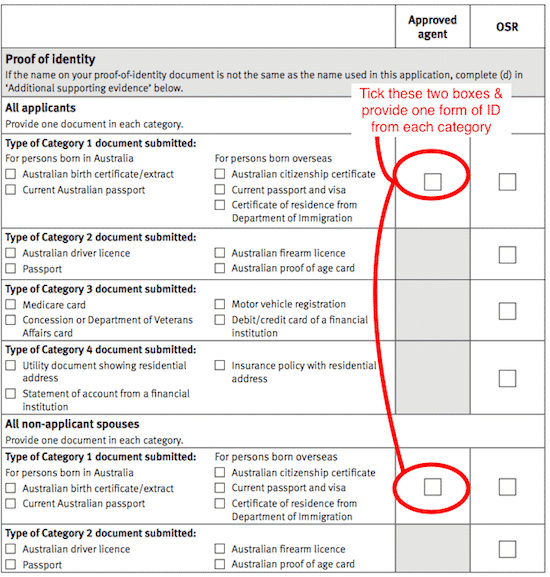

Identification

As we’re completing your application for you, the only ID you’ll require is one document from “Category 1” (circled in red below) for yourself, and one for your partner or spouse if you’re applying with them.

If you were born in Australia, you must provide ONE of these documents:

- Australian birth certificate or extract

- Current Australian passport

If you were born overseas, you must provide ONE of these documents:

- Australian citizenship certificate

- Current passport and visa

- Certificate of residence from the Department of Immigration

These documents must be copied and witnessed by a Justice of the Peace (JP) or Commissioner of Declarations. This can be done in our office, or, if it’s more convenient, many Court Houses and even Libraries offer a free JP or Commissioner of Declarations service.

If you have a “non-applicant spouse” (a partner with whom you live with who will not be on your application) they will also need to provide ID in the second half of this section (circled in red below).

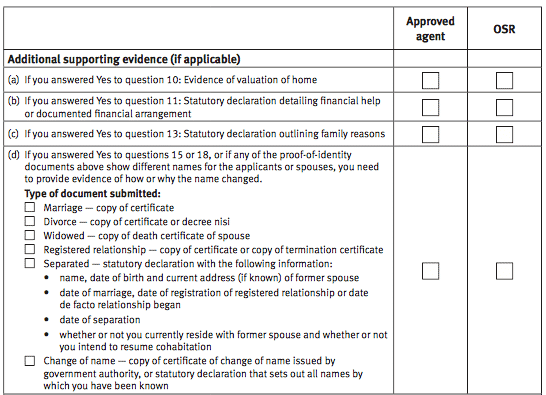

Additional Supporting Evidence

This section only applies under certain circumstances, such as explaining why your name may be different on various documents due to a name change, marriage, or divorce. We will take the time to help you determine whether you need to fill this section out or not.

Contracts

In this part of your application, you need to provide a copy of your building contract or purchase contract and any other associated documents that prove you are buying or building a home that meets the eligibility criteria.

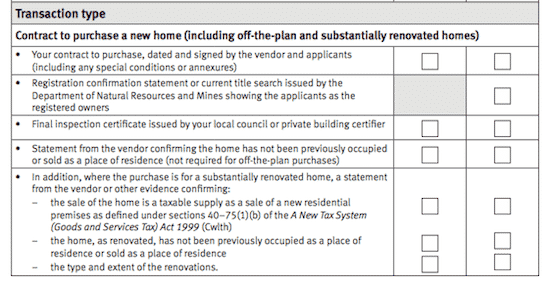

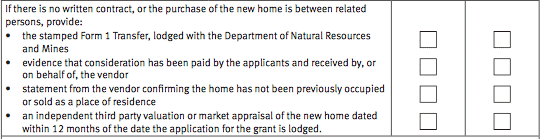

Purchasing your new home (including “off the plan”)

If you’re purchasing a new home (including “off the plan” properties), you must provide the signed and dated contract plus a final inspection certificate and a statement from the vendor that confirms the home has not been previously occupied. We should already have these documents on file from your home loan application.

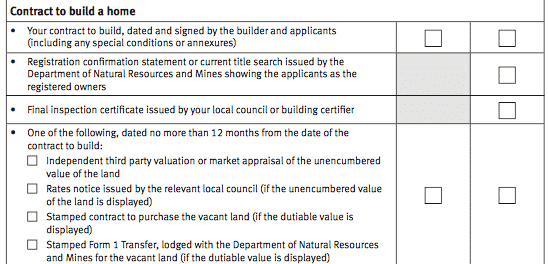

Building your new home

If you’re building your first home, you must provide a “contract to build” which has been dated and signed by your builder and all your applicants. You must also provide one additional item that shows the value of the land. You can choose from the list of acceptable items on the application form. Again we will already have this documentation on file.

Chapter 8

Frequently Asked Question on the First Home Buyers Grant

Here are the short answers to some of the most frequent questions we get asked about the First Home Owners Grant QLD.

1. Does my income effect if I get the $30,000 Grant?

No, the there are no income tests to get the $30,000 First Home Buyers Grant. You do need to meet banks lending standards to get a home loan approved.

2. What is the maximum I can spend on building a home to get the First Home Owners Grant?

You can spend up to $749,999 in total which needs to include the cost of the land, plus build plus any extras like driveway, landscaping, solar etc.

3. What happens if I move out of my home in less than the 6 consecutive months required within the first year?

You will probably need to repay the Grant back to Office of State Revenue. I recommend calling them before hand rather than having them find out.

4. Can I get the Grant if the property is to be rented out for a few months, beginning within the first 12 months of completion of the property, before I move in?

No you must live in the home yourselves first for at least 6 consecutive months before renting it out.

5. I intend to move into the home as soon as it is completed, but can I also rent out a room in the house to make money?

Check your specific circumstances with the QLD Office of State Revenue first on 1300 300 734 or you may need to repay the Grant.

6. I am buying with a partner and we are both first home buyers. Do we both get the Grant?

No, you only receive one payment of $30,000.

7. I am buying with a partner and only one of us is a first home buyer. Can we still get the Grant?

Maybe. It depends on how long you have been together. Best to call me to confirm. You may be eligible for a partial Stamp Duty Concession though.

8. I have never owned property in Australia before but I have owned a home overseas. Can I still get the Grant?

The QLD Office of State Revenue states you must not have owned property in Australia before. It does not specifically say you can not have owned property overseas. This is a bit of a grey area so best to call the QLD Office of State Revenue yourself on 1300 300 734.

9. Can I get the Grant if I have owned an investment property but I have never lived in it?

Maybe, there are some exemptions if you can prove the property has always been rented, for example with rental transaction statements from the managing real estate agent. Speak to the QLD Office of State Revenue.

10. Can I use the $30,000 Grant as a deposit to buy a block of land which I will build on later?

No, the $30,000 Grant goes towards the cost to build your home. You need enough savings to buy the land. So you can’t use it as a deposit to buy a blocks of land and then build on later. The Stamp Duty Concession covers the purchase of the land where you can get up to $7,175.

What do I need to know about Construction Loans?

When building a home, the loan you will need to take out is technically called a ‘construction loan’.

Construction loans are designed specifically for building.

They let you buy the land first and then down the track, whether it’s weeks, months or years later, you can apply for the loan to cover the cost of building the home.

There are many reasons why you need to secure a block of land first before finalising the building contract.

For starters, you’ll need to make an offer on the land so no one else does.

Also the design of the home needs to suit the block of land so the designs may need to be modified.

There are a lot of decisions regarding the layout, styles, materials and colours etc to be made which can take you weeks or even months depending on how quickly you make your decisions and the turnaround time of the builder in getting back to you with a final costing.

When taking out each loan (land first then the build later) you will need to contribute approximately a minimum of a 7% deposit each time to get the loan approved by the lender.

My name is Victor Kalinowski and I’m a mortgage broker at Blackk Mortgage Brokers, with offices based in West End (Brisbane) and Burleigh Heads (Gold Coast). We help people buy homes throughout Queensland.

Please go ahead and book a free 20 minute call with me here if there is any way I can help you further.

The information contained within this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2024.