Seven options to help manage your mortgage repayments (and budget) through COVID-19, including the mortgage freeze.

If you have a mortgage (or two) right now, you may be feeling concerned about how long you are able to continue making loan repayments for and how to cover household bills.

At the moment we are seeing frequent action from the Reserve Bank, Federal Government and major banks with the roll out of stimulus packages, income payments and new policies which may ease the financial strain for many Australians.

In this post I want to give you some clear guidance on the steps to take to first get clarity on where you stand financially, and then what action you need to take to manage your mortgage repayments (both owner occupier and investment loans).

First up I will say that while it is tempting to take banks up on their offer of a ‘home loan repayment freeze’, my general advice is to be cautious and do what you can to keep your loan repayments up for as long as possible. Read more on this in section 6.

Here are the seven options to consider to help manage your mortgage (and budget) if you are under financial pressure:

1. First, get clarity on your income and expenses for the next 6 months.

2. Switch to making only the minimum mortgage repayment required.

3. Can you redraw advanced repayments from your home loan?

4. Do you need to consolidate multiple debts into your home loan?

5. Should you refinance your home loan?

6. Consider a home loan repayment freeze / holiday for 6 months.

7. Should I access my superannuation?

Please get in touch if you want to talk about your situation in more detail and you can book a call with me here.

1. First get clarity on your income and expenses for the next 6 months.

Right now I recommend everyone have a look at their income and expenses and also what government incentives you may be able to access to boost your income.

You need to get clarity on your situation for at least the next 6 months, so you can see exactly where you stand.

While it is tempting to put your head in the sand and ignore what is going on, never has there been a more important time to get a handle on this.

Knowing your bottom line will help you to determine what action you may need to take.

Take stock of the following:

- What is your expected monthly income for the next 6 months or so:

- Salary / wages expected

- Government benefits and incentives expected

- How much cash do you have access to right now?

- Is there any way to earn extra income?

- How many weeks/ months can you get by for?

- What are your necessary expenses and debt repayments?

- What are fixed or ones you can not get out of?

- What expenses can you cancel or put on hold?

- Once you have this clarity:

- Do you need to put mortgage/s on hold for 6 months?

2. Switch to making only the minimum mortgage repayment required.

Whilst I always recommend paying off your home or investment loan sooner with extra repayments, pandemic’s are an exception to this.

If cash flow is tight, call your bank or go online and reduce your loan repayments to the minimum required for now.

When your home cash flow is back to a level you are comfortable with, then I recommend you go back to making extra repayments.

3. Can you redraw advanced repayments from your home loan?

With interest rates so low, many people have been diligently making extra repayments above the minimum required.

If you have done this, you should be ahead on your home loan repayments.

Depending on the type of home loan you have, you should be able to access some or all of this money:

- On a 100% variable rate home loan – you can access all extra repayments made;

- On a split loan (both fixed and variable rates) – you will only be able to redraw money on the variable portion of your home loan;

- Loan is on a 100% fixed interest rate – you won’t be able to redraw any funds however under special circumstances you may be able to so call your bank directly.

If you have a variable loan (or a portion of your home loan is on a variable interest rate), then you should be able to access this money through your redraw facility for no extra charge.

You can use this money to make your minimum loan repayments and for general living expenses / bills.

To check how much you are ahead in your repayments, have a look at your online banking. This will show as ‘available funds’ or ‘redraw’ on your home loan account.

You can usually transfer this money straight into your linked transaction account or linked offset account and you’ll get access to the money fairly quickly.

Some lenders will have a daily maximum limit you can transfer, so just be aware of that.

Remember also that you will need to advise the bank that you want to make the minimum (or at least lower) home loan repayment for what ever period of time you choose. If you don’t alter them, the direct debit will remain the same.

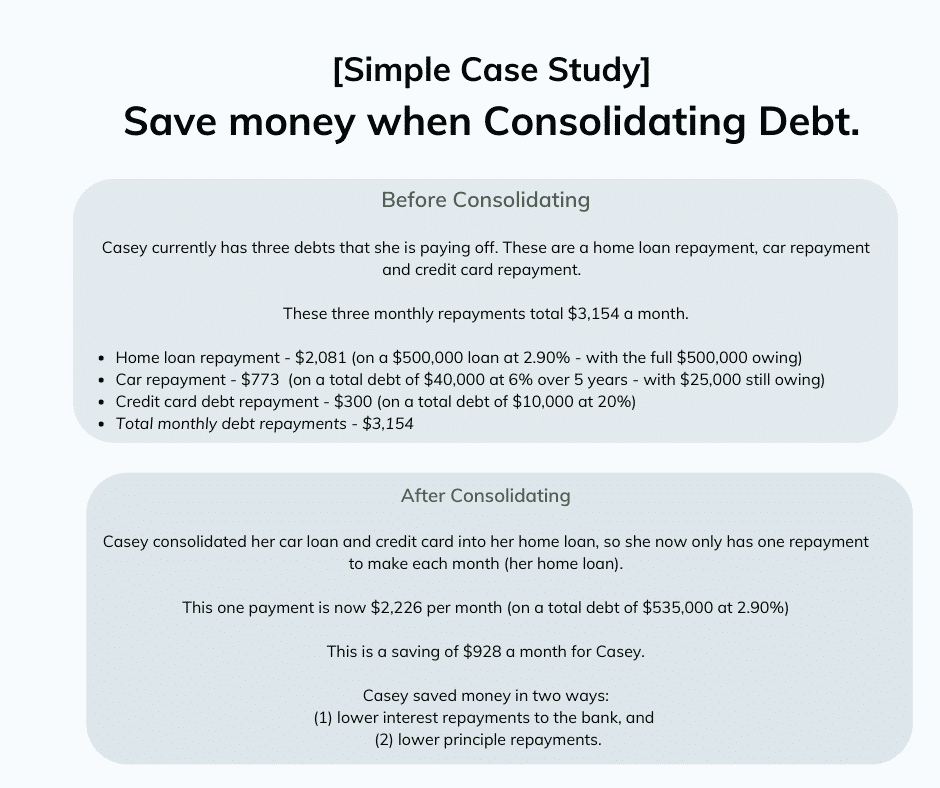

4. Do you need to consolidate multiple debts into a home loan (if relevant)?

For most people, their debt repayments are by far the biggest expense of their salary/s, so let’s take a look at how we can save you some money there.

If you are currently making multiple repayments across credit cards, a car loan and your home loan, then lets have a look at what would happen if we consolidated this into your home loan.

When we consolidate your debt, this can either be done with your existing home loan lender or we may need to refinance you to another lender if we can find you a better deal elsewhere.

Pooling all your debts into your home loan might save you money.

If you do have multiple debts and loans you are repaying please give me a call to go through this.

As you can see, there are substantial savings to be made, however we really need to run these numbers for your individual situation.

Please note, that to consolidate debt in the COVID-19 era, you will need ‘secure employment’. I am receiving daily updates from lenders who are changing their policies and making it harder, if not impossible for people working in certain industries to either refinance or get a home loan as they are aware that the virus is significantly impacting these industries.

As at the date of publishing, banks are unlikely to approve a home loan or a refinance if you work in any of these industries – airlines, beauty, hair salons, gym / training, tourism, short term rental accommodations, hospitality, retail (this list is likely to grow).

5. Should I refinance my home loan?

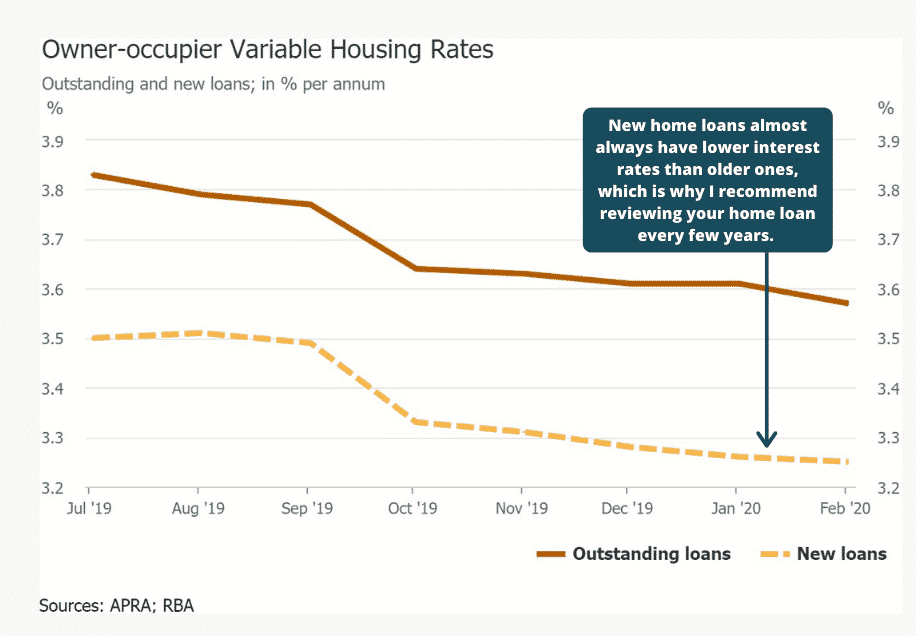

Refinancing your home loan or investment loan could be beneficial for some of you, especially if you have not refinanced in the last 3 years or more.

This probably means the bank doesn’t have you on the sharpest rate and given interest rates have fallen in this time, now is a very good time to review this.

I will be providing you with more information on this shortly.

It is best to give me a call or book one here if you would like to do this.

Banks offer lower rates to new customers so now is a good time to consider refinancing.

Please note, that to refinance in the COVID-19 era, you will need ‘secure employment’. I am receiving daily updates from lenders who are changing their policies and making it harder, if not impossible for people working in certain industries to either refinance or get a home loan as they are aware that the virus is significantly impacting these industries.

As at the date of publishing, banks are unlikely to approve a home loan or a refinance if you work in any of these industries – airlines, beauty, hair salons, gym / training, tourism, short term rental accommodations, hospitality, retail (this list is likely to grow).

6. Consider a home loan repayment freeze / holiday for 6 months.

There is a lot in the media at the moment about home loan freezes or holidays for 6 months.

Let’s go through what this means and if it is the best option for your household.

This option should be reserved for an emergency situation which I cover below.

Should I take on a mortgage freeze right now?

First up I’ll say, try to avoid taking on a mortgage freeze for as long as possible.

The reason for this is as follows.

No one knows for how long COVID-19 restrictions will be in place for, but at some point all these restrictions will lift and the economy will start to return to a ‘new normal’.

We also do not know if the banks will extend mortgage freezes for more than the 3 to 6 months they are offering – so what will your income situation be at the end of the freeze?

So if you can wait till July to go on a mortgage freeze, then you come off in January 2021, there is a higher chance that jobs will be starting up again.

On the other hand, if you take a mortgage freeze in April and you come off the freeze in October, then it is likely that jobs will not be in as a good a position as they will be in January.

Also remember that banks will asses you on a case by case basis and I believe that in the short term they will be fairly generous giving most people the mortgage holiday.

However over time they may become more discerning. For example, they may be more willing to extend the mortgage freeze for a family with just their owner occupier home loan, rather than someone with an owner occupier home loan and three investment properties.

We will continue to monitor this.

What exactly is the COVID-19 mortgage holiday or freeze?

Almost all banks are offering customers who are effected by COVID-19, the chance to freeze their home loan and investment loan repayments.

This means you can pause your loan repayments for a limited time to help relieve your financial pressure.

If you do go on a mortgage freeze, the good news is this is not treated as a traditional hardship case, meaning this will not be flagged on your credit file (which is very important for any future refinancing or borrowing you may want to do).

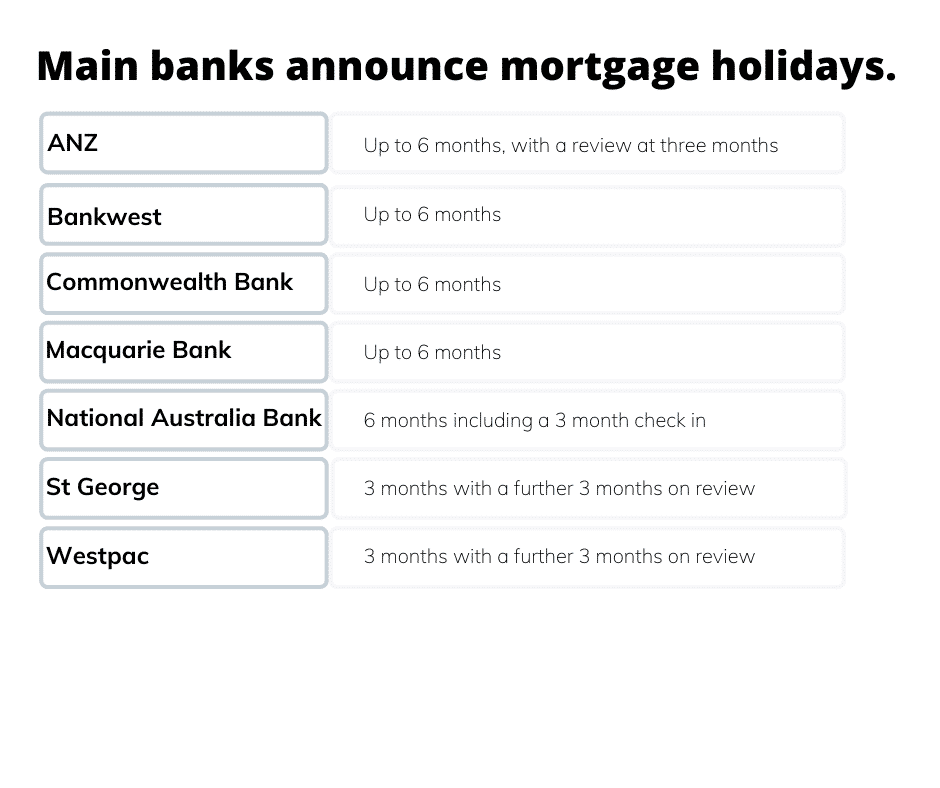

The terms and conditions offered by each bank is different, so you will need to contact your bank directly.

Some banks are offering a 3 month deferral of repayments, with a further 3 month extension possible, while others are a straight out 6 month deferral.

How does a mortgage holiday work?

Once you have successfully applied for a mortgage holiday, your loan repayments will be switched over to ‘interest only’.

This means you are only paying the ‘interest component’ of your repayment as it is the ‘principle’ part that has been put on hold.

This interest will accrue (or be capitalised) over the freeze period so your loan balance will be higher when you come off the freeze.

So whilst you are temporarily relived of financial pressure, the reality is you are simply pushing the problem out to later in the year.

As time goes on you will need to monitor how your income is changing and be aware of how long will it take for your income to recover to the level you need to comfortably meet your repayments.

The banks are handling this as a case by case basis.

How much will a mortgage freeze add to my home loan balance?

While you are not making any repayments, your home loan is still accruing interest and will be added to the balance of your home loan.

Let’s go through an example:

Assume the mortgage is $500,000, and there is a 4% interest rate.

By the end of the 6 months period, the mortgage balance will have increased by the interest accrued which is $10,000.

- End month 1 – loan balance up by $1,666 (to $501,666)

- End month 2 – loan balance up by $1,672 (to $503,339)

- End month 3 – loan balance up by $1,678 (to $505,016)

- End month 4 – loan balance up by $1,683 (to $506,670)

- End month 5 – loan balance up by $1,689 (to $508,389)

- End month 6 – loan balance up by $1,695 (to $510,083).

If you do decide to go on the mortgage freeze, you will need to ask your lender how you are expected to repay the extra $10,000.

Options may be:

- Increase the repayments to reflect higher loan balance; or

- Increase the the loan term, for example, from 28 years remaining to 28 years and 6 months, which will keep the repayments at what they are normally.

What if my loan repayments are interest only?

If you are already on interest only repayments, and that period is about to expire, I don’t think banks will extend it.

They will switch your repayments over to principle and interest repayments, and put you on the mortgage freeze.

What if I still can’t make my mortgage repayments when the 6 month holiday ends?

In six to nine months time, no ones knows where COVID-19 will be at, what the government or banks will do to support home owners or where the economy will be.

There is no point trying to pre-empt this.

You are better off to deal with this scenario closer to the time.

Please make sure you contact your lender to discuss your situation at least one month before the home loan holiday ends.

What should I tell the bank when I speak to them about taking on a home loan freeze?

Most banks will ask questions to understand what your situation is.

Before you call up, have your facts ready to make your case and make your story short and to the point.

Have your facts ready:

- What you do for work;

- How your job has been impacted;

- Your weekly or monthly income just before COVID-19;

- What your income / household income is right now:

- Your partner / spouses income is and how secure their job is;

- Cash you have saved or can access right now.

Question to ask:

- How long can I defer my repayments for?

- What if i need to extend the freeze for longer?

- Is there a fee?

- What happens to my repayments once the freeze is over:

- Extend the loan term out to keep the loan repayments; or

- Make a higher repayment

7. Access your superannuation

The federal government has taken the rare step of allowing people to access some of their superannuation to help cover their mortgage and living expenses during COVID-19.

To be eligible to receive this, there are some requirements such as your paid work hours have been reduced by 20% or you have been made redundant, which you can see in the link below.

The government is allowing you to access up to:

- $10,000 for the 2020 Financial Year (ending 30 June 2020), plus;

- Another $10,000 for the 2021 Financial Year (must be accessed from 1 July 2020 to 24 September 2020).

This means you can draw out $10,000 on 30 June, and another $10,000 on 1 July 2020, totalling $20,000.

Also remember you can get this money out tax free for now (normally it is taxed). If you want to add to super again later you need to be aware of how this will be taxed so talk to your, financial adviser or accountant.

There are many critics of this approach with some economists saying the government should not be encouraging people to reduce their super balances. However this is a voluntary option and if you are interested, again ask your your accountant or financial adviser for advice.

At the moment you can ‘register your interest’ and you will be notified when you need to take further action.

Full details can be seen here.

Other frequently asked questions

What will happen to property prices?

There are many factors that effect property prices, such as the unemployment rate and also the government and bank interventions that are changing quickly.

It is unclear as to what extent house values will be impacted, but it is important to remember that the trajectory for housing will shift once the economy moves toward normal, full scale production again in the future.

Certainly the government is doing it’s best with what can only be described as huge stimulus packages, so we will need to watch closely.

Should I fix my interest rate?

There are some very good deals out there right now enticing borrowers to fix their interest rates for a period of time.

Should you take one of these up to save money?

The answer depends on your individual circumstances like what interest rate you are on and if your home loan is able able to be changed.

I always say that if you want peace of mind of a set repayment each month, then you may want to fix your rate.

But always remember you are not likely to beat the banks at their own game.

Banks are offering attractive fixed rates for a short term, like 1 or 2 years, as they still think they can win out of it.

So what will happen to interest rates in the short term?

Well historically, the RBA has increased or decreased cash rates by a quarter of a percent (0.25%) each time.

So in theory the RBA has only one more drop left before we get to zero percent cash rate (we are on 0.25% right now).

When banks are setting their interest rates, there are other factors that effect rates more than the RBA cash rate, which is often why banks usually do not pass all of this RBA cash rate drop onto their customers.

At the 19 March 2020 drop a few weeks ago, most banks didn’t reduce their variable rates and only some reduced their fixed rates.

My opinion

The way I see it, there is not a lot of room left for variable rates to fall (so fixing is more desirable than a year ago).

But I still personally believe that banks play to win so if they are offering these fixed rates now, then perhaps variable rates still have further to fall?

A good balance for you may be to fix a portion of your home loan, while leaving some as variable. That way, with the variable portion, you can still access funds in your offset account and take advantage of any further rate drops.

Please book a call with me if you want to talk about where you are at with your home loan.

I am concerned about paying off my home loan, what should i do?

Run through the 8 options shown here and please call me if you want to discuss.

What other government income support I can access?

As it seems to change every few days it is best to start here and see what you are eligible for.

Please get in touch if you want to talk about your situation in more detail and you can book a call with me here.