How to pay for a Home Renovation [Guide for 2022].

Does your home need some sprucing up?

A complete new kitchen with marble bench tops, a back deck or an extension for a bub on the way!

Whatever you are dreaming up, the real question is what is stopping you from getting started renovating your home now?

The answer, is most likely to do with money…

It all comes down to what you can afford and what the bank will lend you.

This post covers the five main ways to fund your home renovation.

You can also download summary guide below.

So let’s get into it!

Chapters

- How much can I spend on home renovations?

- Get an idea of scope & budget

- Five finance options to consider

- Which finance option is best for me?

- Finalise the scale of the renovation

- Applying for a home renovation loan

Chapter 1: How much can I spend on home renovations?

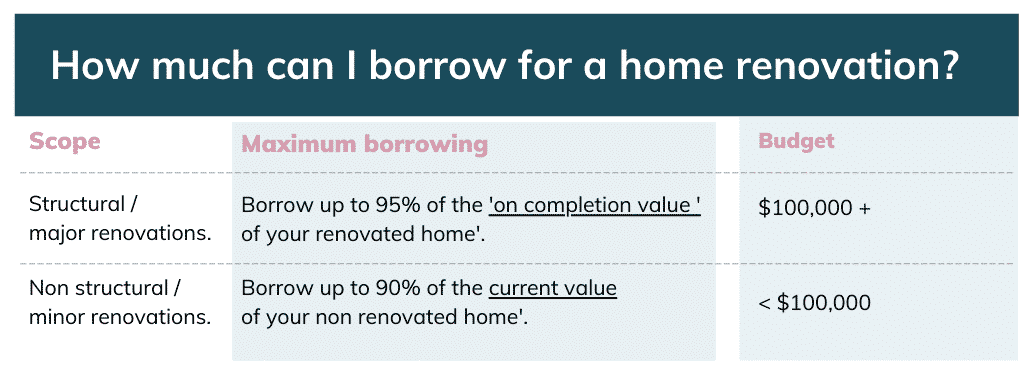

What I can borrow at glance?

If you want some home renovations done, and you don’t have the cash saved to pay for it , then you will need some kind of financing.

The amount you can borrow is linked to both:

- Your income, levels of debts, value of your property, equity in the property, and

- The type of renovation you are doing (structural v non structural renovations)

Structural / major renovations

If you are changing the floor plan, for example by adding new rooms and moving walls, then it is considered a structural or a major renovation.

In this case, you can usually borrow up to 95% of the completed value of your home.

For example, if your home has been valued at $1,000,000 after the renovations, then you could borrow up to 95% of the value of this (ie, $950,000). If your existing home loan is $850,000, then you could borrow another $100,000.

Non structural / minor renovations

If you are doing what is considered to be a minor renovation, for example, putting in a new bathroom, a full new kitchen, new flooring and a paint job, then it is considered a minor renovation.

If this is the case, you can usually borrow up to 90% of the completed value of your home.

For example, if your home has been valued at $1,000,000 before the renovations, then you could borrow up to 90% of the value of this (ie, $900,000). If your existing home loan is $700,000, then you could borrow another $200,000.

Chapter 2: Get an idea of the scope and cost of your renovation.

Getting a ball park budget

The best place to start with bringing your renovation dreams to life is by getting quotes from trades people who would do the renovations.

By going over your ideal renovation plan with different trades people, you will get a reasonable idea of what you can get done to give you a ballpark budget.

You can prioritise what is a ‘like’ v ‘must have’.

You will need a reasonable estimate of what your renovations will cost, so you can work out the best way to finance it.

It is common to have your costings come in over your ballpark budget, so we often find clients either decrease the size of work or increase their budget.

It is very easy to get carried away with creating a beautiful home with endless inspiration on the socials – the hard bit is working within a budget.

One of the hardest parts of being over budget is it can be a long drawn out process scaling back your plans.

In fact, I would recommend doubling or even tripling the cost you have in mind right now as almost everyone I know who does renovations comes in over budget.

Structural or Non Structural Renovations

You need to know if the work is considered structural or non structural, as this determines both how much you can borrow and how the funds are paid.

Structural (major renovations)

Structural renovations involve changes like:

- Moving walls

- Adding new rooms / new level

- Changing the property’s floor space

It is like a complete over haul of your home where you can create new spaces exactly as you have dreamed, so the home is more liveable for family life.

Older homes are sometimes a ‘renovators dream’.

They commonly need a structural renovation as often they have smaller, separate rooms and most people prefer to make their home open plan and add on new rooms.

These types of renovations are costly, usually over $100,000 and up to $1 million (or more) depending on what you want to achieve.

You will need an architect or engineer to draw up your plans and assess the structural integrity of your home.

You will also need a builder and tradespeople, like electricians and plumbers to bring your plans to life.

Non structural (minor renovations)

Examples are:

- New kitchen

- New bathroom

- New flooring or painting

- Pool, solar and landscaping.

For example, if you are putting in a new kitchen and brand new appliances, then go and see a few kitchen shops to touch and feel the different bench tops (granite V laminate etc), cupboard materials and find out the installation costs. Also get clear on exactly which brand and type of oven, stove top and kitchen sink you want, that way you have a full quote covering everything.

Read more: How to build a house

If you are updating the look of your kitchen, it is considered non structural. pic @lloyd_lloyd_design

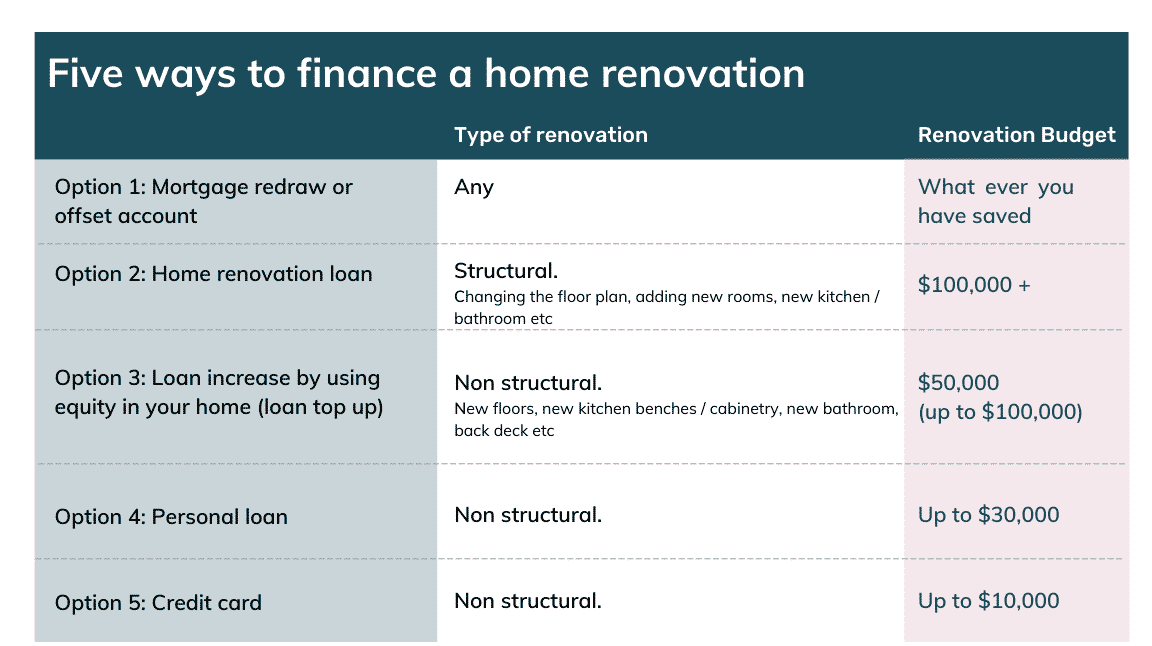

Chapter 3: Five options to finance my home renovation.

The easiest way to pay for your renovation is to have a heap of cash sitting in your home loan offset account or redraw that you can access to pay for it.

If this is not the case then it is likely that you will need to borrow money.

There are five finance options to consider which I will take you through in one moment.

Please remember that I have tried to keep it all simple but this stuff is complicated so if you are not sure what is best, please just book a free 15min call with me right here.

Option 1: Use your mortgage redraw or offset account

- Type of renovation: Any

- Renovation costs: Whatever amount you can access in your offset / redraw account.

The best way to pay for a renovation is with money you have already saved or have sitting in your mortgage redraw or offset account (it is like your savings account).

To access the money, most lenders simply allow you to log into your internet banking and transfer the money.

The main disadvantage with this approach is it reduces your savings buffer or emergency money, so it is up to you as to how much of these savings you put towards your home renovation.

Read more: Are home loan offset accounts worth it?

Option 2: Home renovation loan (also knowns as a construction loan)

- Type of renovation: Structural (changing the floor plan, adding new rooms)

- Renovation costs: More than $100,000

If you do not have enough equity in your home, or you want to borrow more than $100,000 (as a guide), you will need to do a renovation home loan.

Technically this is called a construction loan and is the same kind of home loan you would have if building a home.

You may be able to stay with your current lender, or you may need to change lenders to get a home renovation loan approved.

You will need to get detailed quotes for all renovations

You will need to get detailed quotes for all aspects of the renovation if you want to borrow the funds to pay for it, including the builder, tradespeople, appliances etc.

The bank will need these quotes, but also, I highly recommend are as accurate as possible with your costings.

It is very difficult to come back to the bank part way through the renovation and ask for more money (they will either decline your request or you could be charged considerably high extra fees to access more funds).

As a part of the process of applying for a home renovation loan, you will need to provide the lender the following:

- Building contract

- Building plans

- Quotes for extra work – many things like landscaping and solar panels are not included in the building contract. If you want money for these, add them into your renovation home loan.

Make sure the tradespeople are clear on exactly what is and is not in scope because it is very difficult and expensive to make changes to your building contract and also it is not easy to go back to the lender months down the track and ask for more money.

A full renovation, like this retro inspired home from from @lloyd_lloyd_design would be considered structural so a Home Renovation Loan would be the best way to finance it.

How a home renovation loan works

Here are the key bits of information I think you need to know, at this point, about a home renovation loan (construction loan).

Getting an ‘on completion valuation’

An important step in getting a renovation loan approved is having a property valuation that projects what your home is worth when the renovation is complete.

Banks lend money based on the completed value of your home and the more your valuation is, the more you can borrow.

It is an important step in choosing a lender to do your loan, as a higher on completion property valuation allows you to borrow more (if you need the space).

The bank will do this on your behalf once you have provided all your quotes.

Progress payments

When your loan is approved, and construction has begun, the lender will ‘draw down’ on the loan to make what is known as ‘progress payments’ to the builder.

This means the money does not go directly into your loan account as the bank manages it for you (banks do this to make sure the money is spent as planned on the renovation).

Interest only repayments

Another great feature of renovation home loans is that while the construction is happening, your loan repayments are ‘interest only’. This means they are a little lower than what they would be if you were making principle and interest repayments on normal home loan.

It takes a bit of the pressure off financially during the renovation, which can come in handy, especially if you are renting elsewhere for a period of time.

How to apply for a home renovation loan

Some lenders do not do construction loans at all, while other lenders do them really well.

Even if you stay with your current lender, you will need to do a full new home loan application, which involves providing your personal and financial information as well paperwork like payslips and banks statements.

It can take from 2 weeks to several months to get a home renovation loan approved depending on the bank you do your loan with.

I can talk you through what is relevant for your personal situation if you book a free 15min call with me here.

Inspiration for a new kitchen @kellehoward.co

Option 3: Loan increase by using equity in your home (loan top up)

- Type of renovation: Non structural only such new floors, new kitchen benches / cabinetry, new bathroom, back deck etc)

- Renovation costs: For renovations under $50,000 (can go up to $100,000)

If you are doing renovations that are non structural and under $100,000 then consider using the equity in your home to pay for it.

This is one of the easiest and fastest way to access money for your renovations.

Equity is the difference between your homes market value, and the balance of your mortgage.

For example, if your home is valued at $1,000,000 and your loan balance is $400,00, then you have $600,000 in equity (your Loan to Valuation Ratio or LVR, is 40%).

Equity is not like cash sitting in a redraw or offset account that you can access when you want.

If you want to access equity in your home, you need to apply for a loan increase (also known as a loan top up).

If your loan top up is approved, the lender will transfer your funds over to your loan account.

You will need to pay the tradespeople directly for their work (which is different to how the funds are managed for a renovation home loan).

Do I stay with my bank or switch to a new bank?

It is easier to simply stay with your existing bank for a loan top up however sometimes you will have no choice but to go through the process of applying to a new lender.

You would stay with your existing bank for a loan increase to access your equity if they meet these three criteria:

- Current property valuation (as is with no renovations)) comes in high enough for you to do the loan increase you want (once you have done the loan increase, you final home loan LVR needs to be under 80%);

- The interest rate on your home loan is competitive, relative to what else is available;

- Lending rules of your bank allow you to access the amount of loan increase you want

For example you might switch lenders if:

- After the loan increase your LVR is now more than 80%, so you are required to pay LMI

- If your property valuation comes in lower than expected, so after the loan increase your LVR is higher than 80% so you are required to pay LMI (and by going to another lender your valuation comes in higher so you could avoid LMI)

- IR better elsewhere (keeping in mind it can cost around $1000 to refinance plus the time it takes to change)

- Your bank’s lending rules do not allow you do do a loan top up based on your financial circumstances.

Using the equity in your home is a great way to pay for an upgrade of a living space. @kellehoward.co/

Do I need to provide the bank with quotes from tradesmen?

Banks are cautions giving people large chunks equity (or money) to spend freely because the bank want to be sure the money is going to a worthwhile purpose.

The more equity you request, the greater the number of questions they will ask.

While it is easy to get $20,000 out, it is not so simple to get $100,000 of your equity out.

Some lenders may require you to provide quotes from tradespeople, before they approve your loan increase.

Other lenders will not require any quotes.

Either way I recommend that you always get quotes from several tradespeople so you have an accurate idea as to how much the renovation will cost.

How to apply for a home loan top up

The process to apply for a home loan top up depends on your lender, as many approach this in different ways.

For some lenders this is a full loan application where you to provide paperwork like payslips again.

Other banks allow you to do this very simply online.

It can take from 2 weeks to several months to get the loan increase, depending on how busy your lender is.

I can give you a better idea of what in involved for you if you book a free 15min call with me.

Add in a new lap pool @kodiakprojects

Option 4: Personal loan

- Type of renovation: Non structural, like a new bathroom cabinet or stove top etc

- Renovation costs: Up to $30,000

I have included personal loans (and credit cards as option 4) as there are some circumstances where it is a good option to finance your renovation with one.

If you were putting in some new appliances, doing some painting or installing an Ikea or Bunnings kitchen yourself, then you could consider a personal loan (or credit card).

It would make sense, for example, if you paid for some small renovations today with a personal loan or credit card because you knew you were getting a tax return or bonus payment or you were selling your home in the next few months. That way you could repay the loan or credit card quickly.

Applying for a personal loan is much faster and it is much easier as there are not as many rules or requirements.

Be aware that the interest rates on a personal loan will be much higher than your home loan and also check what the fees are.

Option 5: Credit card

- Type of renovation: Non structural, like buying paint

- Renovation costs: Up to $10,000

The circumstances for when you would use a credit card are similar to what I have said for personal loans, except that I have recommend you keep the cost to under $10,000 if you use a credit card.

When choosing a credit card, pick the one that offers a low interest rate on purchases.

Chapter 4: Which finance option is best for me [case studies].

With five different options for financing your home renovation, how do you know which is best for you?

Below I have given you examples of three different families, and how I would recommend they finance their home renovation loan.

Much of this is related to the banking concept of an LVR (or Loan to Valuation Ratio) which you may be familiar with as you already have a home loan. In case you are not familar with LVR’s here is a quick re cap.

A simple explanation of what a Loan to Valuation Ratio (LVR) is.

LVR is is the percentage of money you borrow for a home loan compared to the value of the property.

For example, if your home is valued at $1,000,000 and your mortgage is $800,000, then your LVR is 80%.

Why is this important?

This is relevant to know as if your home renovation loan or top up, takes your home loan to an LVR of 80% or more (meaning you have less than 20% of your own money in the home), then you will need to pay Lenders Mortgage Insurance (LMI), which is usually from $2,000 upwards.

LMI is an insurance you pay to protect the bank if you are unable to repay your loan.

Key points

- If your LVR is less than 80% of the property value – this is the best place to be as a borrower as it gives you lower interest rates and you avoid Lenders Mortgage Insurance.

- If your LVR is greater than 80% of the property value – banks consider you higher risk so you pay Lenders Mortgage Insurance. Plenty of people do this, so it shouldn’t stop you from doing your renovations. More it is something to be aware of.

Read more:

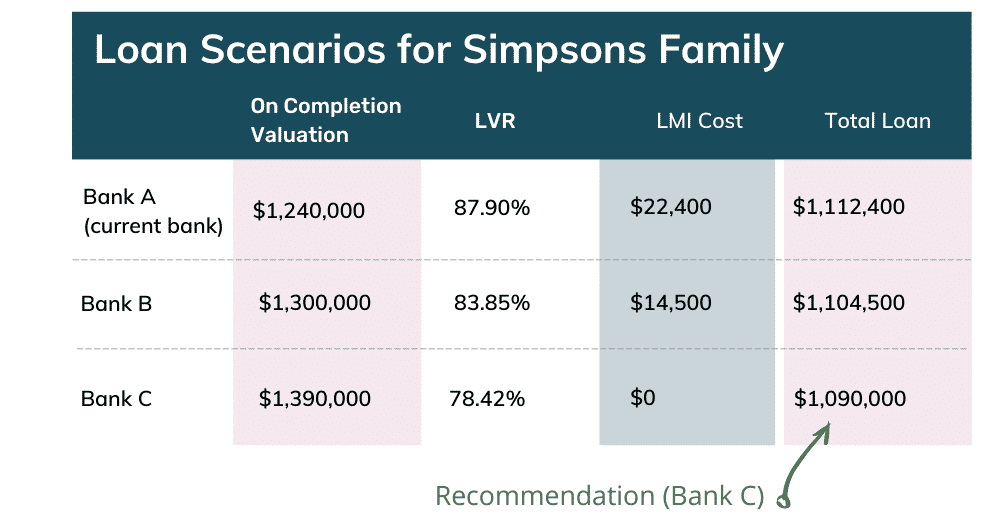

Family 1 | Simpson Family

Finance Recommendation – Home renovation loan with a new bank

The Simpsons have a two bedroom home in Paddington currently valued at $1,500,000, purchased 3 years ago.

Their home loan details are:

- Current home loan balance $1,075,000 (LVR of 71.67%)

- Equity in their property $325,000 (with their existing lender)

- Accessible equity $125,000 (if they borrow up to 80% LVR)

The Simpson family want to do a major structural renovation, reconfigure a bedroom, update the bathroom, update the kitchen and flooring.

After speaking with a few builders, their renovation quote come in at $360,000.

This means their total loan would be:

- Current loan of $1,075,000

- Plus funds for renovation of $360,000

- Total loan = $1,435,000 (95.67% of the current value of the property).

Next I order an ‘on completion valuation’ (a valuation of what the property is worth once the renovations are done), from their existing bank which comes in at $1,850,000. So with a total loan of $1,435,000, the LVR would be 77.56%.

As the LVR is less than 80%, this family avoid paying Lenders Mortgage Insurance.

They also get a better interest rate on their loan (compared to what they would they get with an LVR higher than 80%).

We add this cost of $22,400 to the home loan, so the total loan would be $1,112,400.

What stands out to me here is that the LMI the Simpson family need to pay LMI of $22,400 which is a lot and I would look at other lenders to see if we could reduce this cost.

After looking at two other lenders, these are the results.

I would recommend the Simpson family get a home renovation loan with Bank C, because the on completion valuation is higher, so the LVR comes in less than 80%. This means there is no Lenders Mortgage Insurance to pay so the total loan will be $1,090,000.

Also, as the LVR is below 80%, it means the loan will have access to lower interest rates than Bank A (current bank) and bank B.

As you can see, a Mortgage Broker will compare financial scenarios across multiple lenders looking at what is the most cost effective situation as well as which lenders will actually approve your home loan.

Family 2 | Maple Family

Finance Recommendation – Home renovation loan with their existing bank

The Maple’s have a three bedroom home in Teneriffe currently valued at $1,700,000, and purchased 11 months ago.

These are their home loan details:

- Current home loan balance is $1,500,000 (LVR of 88%)

- Equity in their property $200,000

- Accessible equity $0 (i.e. already borrowed more than 80% LVR)

The Maple family want a new kitchen and want to add a bedroom for a growing family.

After speaking with some builders, their renovation quote come in at $240,000.

This renovation is considered structural, because they are changing the floor plan / structure of the building.

The only way to finance this is to do a home renovation loan:

- As the current home loan LVR is already more than 80%, any new loan will be further increasing the LVR so the Maple family will need to pay more LMI (they already paid LMI when they purchased the home so this will count as a credit);

- When a renovation is structural, like this one, the bank only allows you to get a renovation home loan. There are a few reasons for this, which includes controlling the drawdown of the funds to the builder, ensuring the renovation is built to specs and making sure the builder has QBCC insurance (to ensure the renovation is completed if the builder goes bankrupt part way through the build);

- As this is a home renovation loan, the amount you can borrow is based on the ‘completed value’ of the home, which usually means you can borrow, it reduces the cost of LMI and you save on the interest rate.

I would recommend the Maple’s take out a home renovation loan with their existing bank, as they will already have a credit for the Lenders Mortgage Insurance paid.

Family 3 | Jackson Family

Finance Recommendation – Loan Increase

The Jackson’s have a three bedroom home in Camp Hill, valued at $1,000,000.

- Current home loan balance $600,000 (LVR of 60%)

- Equity in their property $400,000

- Accessible equity $200,000 (i.e up to 80% LVR)

The Jackson’s want to update the kitchen, two bathrooms and landscaping.

Their renovation quote come in at $180,000.

This renovation is considered non structural, because there are no structural changes.

The best way to finance this is to do a loan increase (option 2 above) which would release up to $200,000 to pay for this.

Because this is such a large renovation at $180,000 the family will need to provide the lender with quotes to justify the money.

The bank will release the full funds into their offset account at settlement, which means they can pay the tradespeople themselves as and when the work is done / full control in the time they want.

Victor and Amanda are part of the team at Blackk Mortgage Brokers. We help you with getting your home renovation loan approved.

Chapter 5: Finalise the scale of your renovation.

With a good understanding of what your ideal renovation could cost coupled with the knowledge of how you will finance it, it is time to make the final decisions around what is in and what is out for your renovation.

Do a detailed budget to finalise the cost

Write down every item you are planning to buy, on a budget spreadsheet, so there are no surprises down the track.

Include even what seems like the smallest items like towel rails or light fittings – the more you can include the more accurate your costing will be.

Some items you may need to add are for storage (if you plan to move all your furniture out during the reno) council fees and

Allow for a buffer

Add to your budget spreadsheet an extra 20% to 30% to cover any items you have forgotten to include.

Even the most detailed spreadsheet doesn’t account for unforeseen or unexpected expenses which are guaranteed to pop up.

Use home renovation apps to track your spending

During the reno, I recommend you spend some time every week, tracking what has been spend. Apps like homezada and renovation budget track can help.

Don’t over capitalise on your renovation

Renovations will add value to your home, which is part of the reason we do it.

But before a bank lends you money, they want to make sure you are not over capitalising.

Before renovating, it’s important to get a feel for the current value of your home compared to others in your area.

This will help you determine what renovations will add the most value to your property and at what cost”

- Speak with local real estate agents about how much your home is worth now and after the renovation is completed. To get the completed value, look at other properties in your neighbourhood, that are similar to what your completed home will be like and se what they sell for.

- Drive past similar renovated homes in your area that have sold to get an idea of prices

- Go online and look at free property market reports to get a feel for the property values of similar dwellings in your area.

For example, say your home is worth $650,000 currently and you are planning on spending $250,000 on renovations. In total you would have invested $900,000.

If a similar home is selling for $800,000 then you might decide that it is not worth spending as much on the renovation. If instead comparable properties are selling for $950,000 or more then it looks to be a lot more advantageous.

Victor, the Mortgage Broker, helping out clients with a home loan in the Brisbane office.

Chapter 6: Applying for a home renovation loan.

When should I see a Mortgage Broker or talk to my bank?

The best time to speak to your bank or Mortgage Broker is when you have quotes from a builder / tradespeople / suppliers for the work you are considering getting done.

I can’t stress enough the importance of good home loan advice at this stage given the time and effort involved in planning your renovation and the knowledge that it is getting harder to finance approved generally.

The earlier you can get some certainty of your financial position – the better – to avoid feeling disappointed later if you cannot afford all your ‘must haves’ or worse, the bank won’t lend you the money at all.

It can give you the freedom to customise your renovation even further, add new rooms like a butler’s pantry or splurge on higher quality granite benchtops or a Miele steam oven.

Typical questions a Mortgage Broker will answer are:

- What can I afford to borrow and repay in loan repayments based on my income and living expenses?

- How much will the bank lend me?

- Which loan option is best for for me?

- What is my home loan worth now (pre renovation)?

- What is my home worth after the renovations are completed?

- What are the steps in the process

Should I get a loan pre-approval before I sign off on a final building contract?

In most cases yes, getting a formal pre-approval is a good way to go.

The only way you will know for sure if you are guaranteed the funds is by actually applying to the bank formally (and we only do this when you are definitely going ahead with your renovation).

As I’ve mentioned, a good Mortgage Broker will give you a pretty reliable estimate of what you can your borrow, but a formal home loan approval is even more reliable.

But even so is still not a guarantee you will get the loan, but if for any reason, there are issues it is best to discover this as early as possible so that you can fix it or make other plans.

Whoever is doing your finance (your bank or Mortgage Broker) should do this for you.

Read more: Home Loan Pre Approvals [When you do and don’t need one]

How do the renovation funds get paid?

How you access the funds to pay for the renovation is linked to the type or scope of the renovation you are doing.

For example, if you are doing structural renovations, you will need a renovation home loan and the funds are paid directly to your builder in phases of construction.

If instead you are doing non structural renovations, like replacing the flooring, painting the walls and adding a new bathroom, then you receive the renovation funds as one lump sum into your bank account.

I’m Victor Kalinowski and I’m a Mortgage Broker at Blackk Mortgage Brokers with offices in West End (Brisbane) and Burleigh Heads (Gold Coast).